On 25 January 2024, Euronext held its first Women in Trading cocktail, a networking event in partnership with Equileap, the leading data provider for gender equality and diversity & inclusion.

Over 40 participants from the trading and asset management communities attended the evening event, an initiative created to further support the position of women in finance.

The Euronext Women in Trading cocktail was the occasion:

- to create a new space to foster sharing, learning and networking opportunities

- to underline Euronext’s commitment to empowering women and reshaping finance to be more inclusive

- to share insights alongside our partner Equileap on gender equality in the financial markets and present our gender equality indices, recently launched together.

Watch the Euronext Women in Trading cocktail ‘best of’ video

Charlotte Alliot, Euronext’s Group Head of Financial Derivatives and 2023 winner of a European Women in Finance Award; Delphine d’Amarzit, CEO of Euronext Paris; Diana van Maasdijk, Co-Founder and CEO of Equileap and Nitharshini Thevathas, Index Business Developer at Euronext shared their experience and thoughts.

Partnership with Equileap

Equileap is a leading provider of data and insights on Diversity, Equity, and Inclusion (DEI), allowing investors to align their investments with their values.

Equileap assesses and ranks companies around the world on gender equality and diversity & inclusion using a unique research methodology.

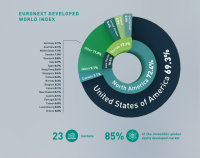

Last year Euronext and Equileap launched the Euronext® Equileap Gender Equality Indices.

More about Euronext’s ESG commitment

Euronext Women in Trading and the launch of Euronext® Equileap Gender Equality Indices are part of Euronext commitment to drive investment in innovative, sustainable products and services and inspire and promote tangible sustainable practices