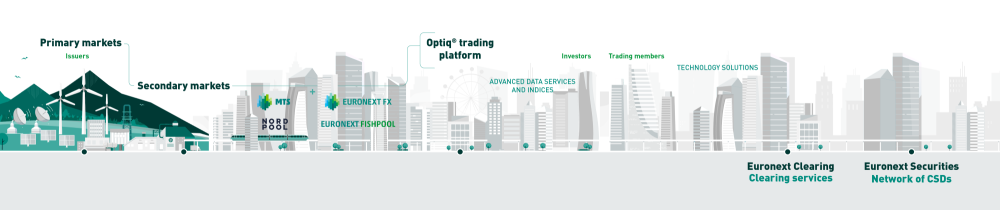

Our Business

We are Euronext

The European capital raising centre

Euronext supports companies from local and international blue chips to small and medium enterprises with listing services to meet their specific needs. Issuers in all geographies and from all sectors can grow by raising capital on our regulated markets in Amsterdam, Brussels, Dublin, Lisbon, Milan, Oslo and Paris, and benefit from exposure to the exchange’s diverse, international client base.

Listing venue of choice

Euronext is the venue of choice for the listing of Equities, Bonds, ETFs, Funds, Warrants & Certificates and Structured Notes:

-

A single entry point to multiple listing markets

-

The fastest listing process in Europe

-

Enhanced visibility

-

Access to a large pool of local and international investors

Diverse Order Flow

Our harmonised market rules and cutting-edge technology platforms attract a wide range of customers worldwide, from small boutiques to institutional investors and global trading members, creating a uniquely diverse order flow.

-

6000+ European, US and international investors

-

350+ active trading members

Full range of market products

Deep liquidity, low latency, simplified multimarket access, diverse investor flows...whatever your needs, Euronext facilitates trading and financial services for clients across the financial value chain.

Multiple Asset Classes

A complete offering from Equities, Financial & Commodity Derivatives and Bonds, to FX, ETFs, Funds and Structured Products.

Leading Technology

Custom and standard solutions for venue operations, regulatory reporting, and ultra low-latency trading for clients worldwide

Post-Trade Services

Our mission is to play an active role in global post-trade infrastructure.

Clearing

Euronext Clearing, formerly CC&G, is being expanded to become the CCP of choice for our cash equity, listed derivatives and commodities markets.

Euronext Clearing now provides clearing services for the Euronext cash markets in Belgium, France, Ireland, Italy, the Netherlands, and Portugal. While Euronext Clearing is not the default CCP for Oslo cash markets, clients in Oslo can still decide to use Euronext Clearing.

In 2024, Euronext Clearing will be expanded to clear Euronext’s listed and commodity derivatives.

Euronext also has relationships with a number of central counterparties (CCPs) that provide clearing services for our markets.

Settlement and custody

Euronext has links with Central Securities Depositories (CSDs) for settlement and custody services.

Under the name Euronext Securities, Euronext also operates four CSDs in Copenhagen, Milan, Oslo and Porto.

Added-value service offering

Corporate Services

Governance, IR and Communication services for listed and private companies

Regulatory solutions

APA/ARM reporting services, insider list management and identification services