All Bell ceremonies

-

7834462fea17-665e-4c23-af53-b129fe5a7f69

EnterNext accueille Pixium Vision sur Euronext à Paris

Bernard Gilly, Président directeur général de Pixium Vision, ouvre les marchés boursiers.

Pixium Vision est spécialisé dans le développement d’implants rétiniens électroniques. Les produits sont destinés aux personnes ayant perdu la vue suite à des troubles dégénératifs de l’oeil tels que la rétinite pigmentaire.

Paris

Paris -

7829f366f571-db8c-4860-92f8-ec93956aae76

Orange Babies sound gong for Mont Ventoux Expedition

Baba Sylla, the director the Orange Babies Foundation, sounds the gong to mark the start of the Mont Ventoux Expedition from 20 to 23 June of this year. He is accompanied by the director of DESTIL, Orange Babies’ partner and also the initiator of the Mont Ventoux Expedition.

On 22 June over 70 participants will run or bike up the Mont Ventoux. They face a daunting challenge on the mountain (elevation 1912m), which is known as the Giant of the Provence. The participants have found sponsors for 1, 2, 3 or 4 climbs up the mountain. Orange Babies will use the proceeds of the Expedition to finance a programme in Africa, which treats babies born with HIV. As was the case last year, the foundation has decided to invest in the Ng’ombe Home Based Care project. The goal of the project is to reduce the rate of mother-to-child HIV transmission in the slums of Ng’ombe, Zambia, from 10% to 2% by 2018.

For more Information: www.orangebabies.nl

Amsterdam

Amsterdam -

7833d62c8276-44bf-4a78-a772-a295dc6982fe

Bell Ceremony pour célébrer la cotation des obligations (Medium Term Notes) émises par Home Invest Belgium

Ce mercredi 18 juin 2014, Sophie Lambrighs, CEO de Home Invest Belgium, a ouvert les marchés financiers à Euronext Bruxelles avec une Bell Ceremony afin de célébrer la cotation des obligations émises par Home Invest Belgium d’une valeur de 40 millions d’euros chez Euronext Bruxelles. Le taux d’intérêt fixe s’élève à 3.79% brut par an.

Sophie Lambrighs, CEO de Home Invest Belgium

Belfius étaient le Sole Lead Managers pour cette opération.

Pour en savoir plus sur la société Home Invest Belgium, une sicafi résidentielle belge, cliquez sur le lien : www.homeinvestbelgium.be

Brussels

Brussels -

7831042e5f0c-489c-4b3a-a805-3a9add523461

EnterNext accueille Bluelinea SA sur Alternext à Paris

Laurent Levasseur, Président du Directoire de Bluelinea SA, sonne la cloche qui ouvre les marchés boursiers.

Bluelinea SA est spécialisé dans la conception et le développement de systèmes électroniques de surveillance et de téléassistance médicalisée. Le groupe propose notamment des badges d'identification et d'authentification des soignants, des bracelets de protection individuelle des nouveau-nés, des dispositifs de maintien et de prise en charge à domicile des personnes âgées vulnérables ou atteintes de maladies chroniques.

Paris

Paris -

78287cb75e2f-1146-4ffe-ba13-14d52a315c7f

International Corporate Governance Network visits Euronext Amsterdam

By sounding the gong, The International Corporate Governance Network (ICGN) marks the ICGN annual meeting, the world’s leading convention for the global corporate governance community, held between 16-18 June in Amsterdam.

ICGN is an investor-led organisation of governance professionals and ICGN's mission is to inspire and promote effective standards of corporate governance to advance efficient markets and economies world-wide. The conference programme features over 30speakers including Jeroen Dijsselbloem,Dutch Finance Minister of Finance and Eurogroup President, Jeroen Hooijer, Head of Corporate Governance, European Commission, Stéphane Hallegatte, Senior Economist, World Bank, Steven Maijoor, Chair, European Securities and Markets Authority and Anne Louise van Lynden, Head of Listing, Euronext Amsterdam. Managing Director Corporate Governance & Responsible Investment at BlackRock, Michelle Edkins and Executive Director at Eumedion, Rients Abma sound the gong.

For more information: www.icgn.org

Amsterdam

Amsterdam -

78327a9941e0-886a-4dd7-a1be-5f81fc670851

REN shares admitted to trading at Euronext Lisbon

Transaction generates proceeds of EUR 157 million

Lisbon – 16 June 2014– Euronext announced today that the sale of the 11% of the share capital of REN-Redes Energéticas Nacionais, SGPS, S.A. still held by the Portuguese State, generated proceeds of EUR 157 million. The 58,740,000 shares offered for sale will be admitted to trading in the regulated market Euronext Lisbon on June 17th, allowing the company’s free-float to increase from the current 20% to 30%.

The price of the second phase of the reprivatisation of REN was set at EUR 2.68. The company’s shares closed today at EUR 2.72, which means a market capitalization of approximately EUR 1,500 million, considering the 534 million shares corresponding to its share capital.

The Portuguese State decided to sell the remaining 11% which it still held in the company led by Rui Vilar through a Public Offering (IPO) in the national market and a direct institutional sale aimed at national and foreign qualified investors.

Of the 58,740,000 shares offered for sale, 11,748,000 shares were allocated to the IPO, including 587,400 shares offered to the employees and 11,160,600 shares offered to the general public. The Direct Institutional Sale was of 46,992,000 shares. Approximately 1,7 million shares of the IPO tranche were reallocated to the institutional sale.

Following the IPO, REN raised 2,155 new shareholders.

“We are very pleased with the success of REN’s Offering, a transaction which underlines the importance of the Portuguese capital markets and Euronext Lisbon as a supporting tool for privatizations open to all the investors”, said Luís Laginha de Sousa, Chairman and CEO of Euronext Lisbon. “The increase in REN’s free float created by this transaction is also a positive element for the market as a whole”, he added.

“The complete privatization of REN´s capital closes a cycle that began with the autonomization of the transport function in the energy value chain. Today we reach a full independence between the concession grantor State and the concession grantee REN, and therefore the conclusion of the institutional model”, said Emílio Rui Vilar, CEO of REN.“I am pleased with the outcome of the transaction because, in addition to the clear demonstration of investors’ confidence, it allowed the increase in the free-float and stock liquidity, which is a positive sign to the shareholders and a greater challenge to both the management and employees”, he added.

Lisbon

Lisbon -

7827673581a0-ed6e-408e-93ef-fda1ef21e531

Four MENA Exchanges close Euronext Markets in Paris

Euronext hosted the CEOs of Amman, Beirut, Tunis and Muscat Exchanges. The CEOs closed Euronext European Markets in Paris.

Mr. Marwan Bataineh - Chairman of Amman Stock Exchange, Mr. Chadi Salameh - Beirut Stock Exchange, Mr. Mohamed Bichiou - CEO of Tunis Stock Exchange, Mr. Ahmed Al-Marhoon - Director General of Muscat Securities Market, along with Mr. Nick Thornton - SVP Global Head of Euronext Market Solutions closed the European trading day in Paris.

Euronext previously announced that it has successfully signed agreements with four exchanges in the Middle East and North Africa (MENA) region for the implementation of its new UTP solution, UTP-Hybrid.

Read the full press release: Euronext signs agreement on UTP implementation with four MENA exchanges (www.euronext.com) Paris

Paris -

7826c8fdd026-a190-449e-86fd-5f98178bd7f4

EnterNext accueille Reworld Media sur Alternext à Paris

Pascal Chevalier, Président de Reworld Media, sonne la cloche qui ouvre les marchés boursiers.

Reworld Media est un groupe media multi canal générateur de relations entre les consommateurs et les marques à travers un process éditorial novateur.Le groupe exploite des marques medias propriétaires, notamment Marie France, Télé Magazine, Gourmand, Papilles, Vie Pratique Féminin et Vivre en Grand, sur leur support historique et les décline sur les supports digitaux soit, sites web, Newsletters, réseaux sociaux et applications mobiles. Il conçoit ainsi des dispositifs medias réactifs et qualifiés, à forte valeur ajoutée pour le consommateur et les marques.Fort d'expertises on line et off line, Reworld Media représente aujourd'hui un réseau de près de 13 millions de contacts mensuels, 3,6 millions d'exemplaires diffusés bi-mensuels et la visibilité de 20 millions de passages en caisse hebdomadaires grâce à son réseau de distribution exclusif en Grande surface.Le groupe est présent en France ainsi qu'à l'international (Espagne, Angleterre, Belgique, Italie, Asie).

Paris

Paris -

Winners of the SME Innovation Top 100 sound gong

| Amsterdam

782542f4d520-eed4-401f-ac27-2b7353bc5fd0Winners of the SME Innovation Top 100 sound gong

The winner of this year’s Top 100 Innovative SMEs, Rik Breur, founder of Micanti, sounds the gong during a visit to Beursplein 5.

On Wednesday 11 June, the Chamber of Commerce, Mercedes Benz and NRC Media presented the ninth annual ranking of the 100 top innovations in the Dutch SME sector. The highest ranking company is Amsterdam-based Micanti BV, producer of a non-toxic, self adhesive foil used to seal the hull of a ship. The foil, Thorn-D, is a patented, environmentally friendly solution designed to prevent organisms such as barnacles and mussels from adhering to the sides of ships.

Second place winner is the family business GPC Kant of Leens in Groningen. The company has developed and patented a machine that can peel 1,000 kilos of the tiny Dutch, or brown shrimp, a day. TheWheel, produced by Apeldoorn-based company e-Traction B.V. finished in third place. TheWheel is a unique electric, direct-drive-in-wheel motor, which means that the stator and rotor are reversed; everything inside the wheel is stationary, while the outside rotates. The wheel itself is the drive mechanism for vehicles using TheWheel system.

For more information: www.mkbinnovatietop100.nl

Amsterdam

Amsterdam -

7824d31b4db2-3320-4089-b667-89ab5eda8f53

Succès des opérations d’augmentation de capital de PSA Peugeot Citroën à Euronext Paris

Jean-Baptiste de Chatillon, Directeur Financier de PSA Peugeot Citroën, célèbre aujourd’hui cette opération historique en sonnant la cloche qui marque l’ouverture des marchés financiers.

Euronext félicite PSA Peugeot Citroën, deuxième constructeur automobile européen, pour le succès de son augmentation de capital. A cette occasion, Jean-Baptiste de Chatillon, Directeur Financier de PSA Peugeot Citroën, célèbre aujourd’hui cette opération historique en sonnant la cloche qui marque l’ouverture des marchés financiers. une première augmentation de capital a été réservée à l’Etat Français et au groupe Dongfeng pour 1 milliard d’euros, puis une seconde augmentation de capital avec maintien du droit préférentiel de souscription pour 2 milliards d’euros. L’opération aura été sur-souscrite à 145%. Les montants levés vont nous donner les moyens de remettre nos affaires sur les rails en Amérique Latine et en Russie, de réduire notre dette, d’investir dans nos usines européennes pour qu’elles soient compétitives et d’investir dans des technologies, en particulier dans les technologies de réduction des émissions de CO2.

Paris

Paris -

7818ab97a1fd-cc47-4670-8a2f-1831ae4f63c2

DFT and Tostrams Group sound gong to launch WK2014-index

The Dutch daily Financiële Telegraaf (DFT) sounds the gong to mark the launch of the WK2014-index. The index is an initiative of DFT and Tostrams Group.

The WK2014-index is an index of five Dutch stocks traded on the Amsterdam Exchange, which are sponsoring the Dutch football team during the 2014 Football World Cup in Brazil. DFT (part of Telegraaf Media Group, listed on Euronext, ticker symbol: TMG) will publish the results of the WK2014-index during the tournament. Stocks included in the index are ING (official sponsor of the Dutch soccer team), Ahold (sponsor), Unilever (pizza’s, ice-cream and snacks), Philips (TV-producer) and Heineken (beer and samba shirts). The index starts with a fictional capital of € 100,000 which is proportional invested in shares of the sponsors. CEO of the Tostrams Group, Royce Tostrams, sounds the gong.

The initiators emphasize the airy nature of the index. The index doesn’t give any recommendations or investment advice.

For more information: www.dft.nl

Amsterdam

Amsterdam -

7821868258a7-347d-4e25-a1a7-3f9de4536cdd

Bell Ceremony pour célébrer la cotation des obligations retail émises par WDP

Ce vendredi 13 juin 2014, Tony De Pauw, CEO de WDP SCA et Joost Uwents, également CEO de WDP SCA ont ouvert les marchés financiers à Euronext Bruxelles avec une Bell Ceremony afin de célébrer la cotation des obligations d’une valeur de 125 millions d’euros chez Euronext Bruxelles. Le taux d’intérêt fixe s’élève à 3.375% brut par an.

BNP Paribas Fortis, Belfius, ING et KBC Bank étaient les Joint Lead Managers.

WDP propose des solutions d'entreposage intelligentes, avec un accent particulier sur le développement et la location de biens immobiliers semi-industriels et logistiques.

Pour en savoir plus sur la société WDP, cliquez sur le lien www.wdp.be

Brussels

Brussels -

7822acb165e2-e6b6-4b01-9ef2-a1621c7dcfd0

Amundi ETF lance le premier ETF 'Multi Smart Beta', illustrant sa stratégie d’innovation produits ‘Smart Beta’

Ce lancement s’inscrit dans le cadre de l’expertise d’Amundi, un leader de la gestion d’actifs en Europe, dans l’accompagnement, le conseil et l’offre de solutions Smart Beta pour ses clients institutionnels. Amundi ETF est le 5ème fournisseur d’ETF européen.

Amundi annonce la cotation sur Euronext du fonds AMUNDI ETF Global Equity Multi Smart Allocation Scientific Beta UCITS ETF.

Ce lancement s’inscrit dans le prolongement du partenariat avec l’Edhec Risk Institute Scientific Beta, annoncé en février dernier, qui vise à développer et promouvoir des solutions ETF et Indicielles pour répondre à une demande croissante des investisseurs institutionnels.

La gamme Amundi ETF dispose déjà de briques d’allocation offrant la possibilité de s’exposer sur des indices smart beta ‘mono-stratégie’ : Minimum Volatility, Mid Cap, Small Cap, Growth, Value et High Dividend.

Ce nouvel ETF permet d’aller plus loin en offrant une exposition à un indice ‘multi-stratégies’ actions monde puisque qu’il combine efficacement les 4 principaux facteurs (volatilité, taille, value, momentum) avec les 5 grandes stratégies de diversification smart beta, le tout pondéré selon une allocation 'ERC' (contribution équivalente au risque).

Cet ETF est proposé avec des frais courants de 0,40% et disponible en trois devises : Euro, GBP, USD. Paris

Paris -

BPI rings the closing bell in Lisbon

| Lisbon

783930326999-db47-46f0-847d-fc19cb5fcb7cBPI rings the closing bell in Lisbon

Executive Committee of Bank BPI's rang the closing bell to commemorate the results of the Offer of debt for Equity swap. With this operation, the bank increases the share capital in more than EUR103 million.

Lisbon

Lisbon -

7823c15683f4-d72c-4a36-818d-20b38aa718ff

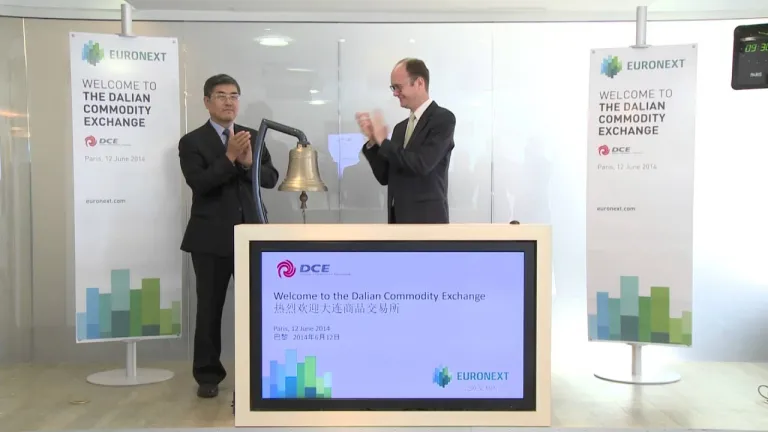

Dalian Commodity Exchange opens the European markets in Paris

Mr. Ming Li, Chairman of the Supervisory Board of the Dalian Commodity Exchange, along with Anthony Attia, Chief Executive Officer of Euronext Paris open the European trading day in Paris.

Euronext today announced that it has signed a Memorandum of Understanding (MOU) with the Dalian Commodity Exchange (DCE). Its aim is to carry out joint research into the promotion, distribution and trading of commodity products, develop new strategies for improving the safe operation of orderly futures and options markets and discuss the feasibility of cooperatively developing new products.

Read the full press release: Euronext and Dalian Commodity Exchange sign MOU Paris

Paris -

7817b48a4b94-3f7a-4b58-8a4f-fe5d72da0ba7

Deloitte Technology Fast50 celebrates 15th anniversary

The Deloitte Technology Fast50 program celebrates its 15th anniversary in 2014. Every year Deloitte searches for the 50 fastest growing tech companies in the Netherlands. To celebrate the anniversary, the winners of 15 years Fast50 are invited to sound the gong.

Deloitte organizes the election in collaboration with partners ABN AMRO, Rijksdienst voor Ondernemend Nederland, AKD, Euronext and MT MediaGroep & Prime Ventures. The competition started 15 years ago to recognize the exceptional performance of these fast growing tech companies. The Fast50 companies have the best entrepreneurs of the future, who think fast and play a leading role in their field. The Rising Star is a special price that is destined for emerging innovative companies that are less than five years old. CEO of TTY, Maarten Beucker Andreae, sounds the gong as the winner of the Fast 50 Sustainable Grower award in 2011.

For more information: www.fast50.nl

Amsterdam

Amsterdam -

ING Private Banking visits Beursplein 5

| Amsterdam

78197967f7d3-2865-41a3-b44e-eb3bf9ff2fa2ING Private Banking visits Beursplein 5

ING Private Banking visits Beursplein 5 and organizes a seminar and visit to the Amsterdam Exchange Experience for its clients. Sounding the closing gong marks the launch of the ING campaign ‘Financieel Fit’.

‘Financieel Fit’ is a program that started earlier this year and is launched aimed at helping clients get into financially sound shape and to make them aware of the possibilities of investing. Rising health care costs, uncertain pension payouts and a limited tax rebate on mortgage interest all make it more relevant for people to accumulate wealth. By combining the certainties of saving with the prospect of greater revenue by long term investing, future financial goals can be reached.

For more information: www.ing.com

Amsterdam -

78202d008cab-178f-485b-8e06-74984d9c05ce

Euronext accueille Elior sur le marché Euronext à Paris

Gilles Petit, Directeur général d'Elior, ouvre les marchés européens à Paris.

Elior figure parmi les leaders mondiaux de la restauration sous contrat. Le CA par activité se répartit comme suit :

- restauration collective (69,5% ; n° 4 mondial) : gestion de restaurants situés dans les entreprises et les administrations (46,3% du CA), les établissements d’enseignement (28%), les établissements de soins et de maisons de retraite (25,7%). En outre, le groupe propose des prestations de services associés (nettoyage, gardiennage, maintenance, etc.) ;

- restauration de concession (30,5% ; n° 3 mondial) : gestion de restaurants implantés dans les aéroports (38,6% du CA), sur les aires d’autoroutes (35,8%) et dans les villes (25,6%).

L’exploitation des restaurants et des points de vente est assurée sous marques propres (L’Arche, Philéas, Ars, Medas, MyChef, Axxe, etc.) et sous franchises (Paul, Quick, Courtepaille, Costa Coffee, Burger King, Starbucks Coffee, McDonald’s, Wendy’s, Dunkin’ Donuts, etc.).

56,1% du CA est réalisé en France. Paris

Paris