Systematic Internaliser

SI registration

(MiFID II Art. 4 & Delegated Act as of 25 April 2016) MiFID II introduces specific quantitative thresholds that determine whether a firm is obliged to register as a SI for a specific instrument or derivatives class. We offer a low-cost, fully hosted solution to operating a SI venue if you are obliged to register.

Pre-trade reporting

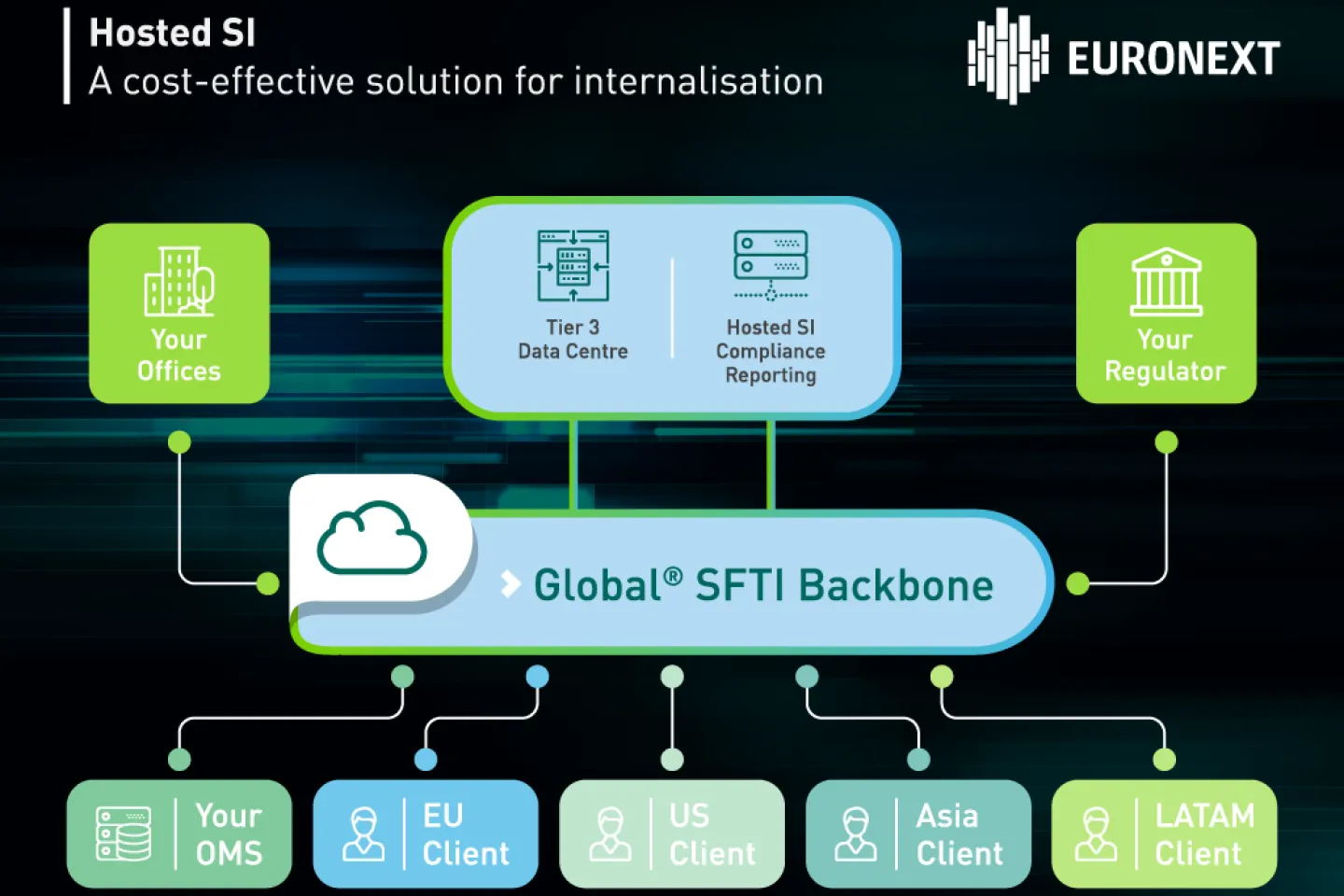

(MiFIR Art. 15 & 18) Public quotes for liquid equity and equity-like instruments are required for all instruments for which you are a SI. This can be done by using Euronext’s APA service, while our SI pre-trade reporting service publishes your quote information over the global SFTI® network.

Quote and trade matching

(MiFIR Art. 15 & 18) As a SI you are required to execute client orders at the price being quoted at the time of reception of the order. Our SI compliant architecture includes low-latency feeds from industry leading data vendors that can be used to generate the executable quotes.

The service is operated using the same technology, infrastructure and security processes used for Euronext regulated markets. Already installed in a Tier 4 standard data centre and integrated with the global SFTI® network, this gives you and your clients the highest levels of service and security confidence irrespective of geography.

- Meet MiFID obligations

- Maximise internalised volume

- Reduce overheads

- Increase operational flexibility

- Reduce time to market

- Reduce infrastructure and operating cost

- Builds on Euronext's proven technology and infrastructure

- Take advantage of existing SFTI® connections for order and market data access

- Maintain a clear view of your venue with customisable dashboards and reports

- Leverage existing regulatory reporting and transparency arrangements