All Bell ceremonies

-

iShares sounds gong for ETF launch

| Amsterdam

7673c0fcd3af-bd55-464e-aeb3-fd70f527f9b5iShares sounds gong for ETF launch

iShares, the exchange-traded funds offering of BlackRock (ticker symbol: BLK), listed its iShares Euro Stoxx 50 ex-Financials UCITS ETF (EXFN) on the Amsterdam market of Euronext. This fund is the first ETF to come to market in continental Europe using an international security structure, where settlement of transactions is exclusively at Euroclear Bank – the Brussels-based international central securities depository (ICSD).Head of iShares The Netherlands, Gert-Jan Verhagen, sounds the gong.

The newly listed iShares EURO STOXX 50 ex-Financials UCITS ETF is a physically replicating fund which invests in blue chip stocks from 12 eurozone countries, while excluding companies from the financial sector, potentially providing investors with a less volatile exposure to Eurozone equities. The fund has a total expense ratio of 20 basis points.

The newly listed ETF follows a successful year of new listings on Euronext’s ETF market in 2013. Euronext reported growth in new ETF listings of 76% versus 2012, with a total of 51 listings on its European market totalling 564 ETFs. In Amsterdam, the growth in new ETFs was up by 223% compared to 2012, totalling 127 ETFs.

For more information: www.blackrock.nl

Amsterdam -

766366814b0c-2b1f-437f-b993-afca95643978

ACTIVITY IN EUROPE

Total amount of capital raised on Euronext’s markets in 2013

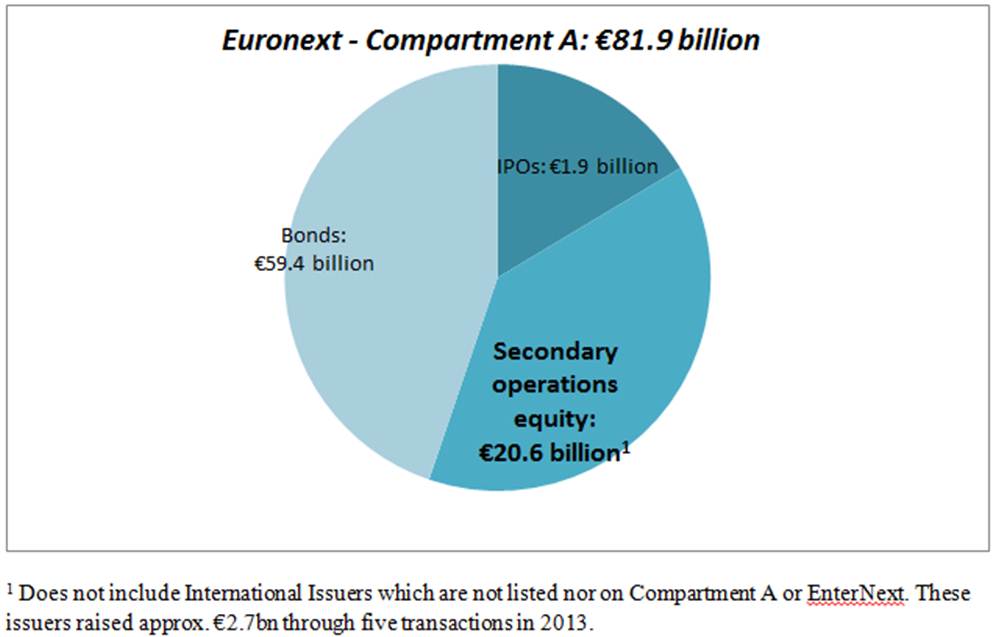

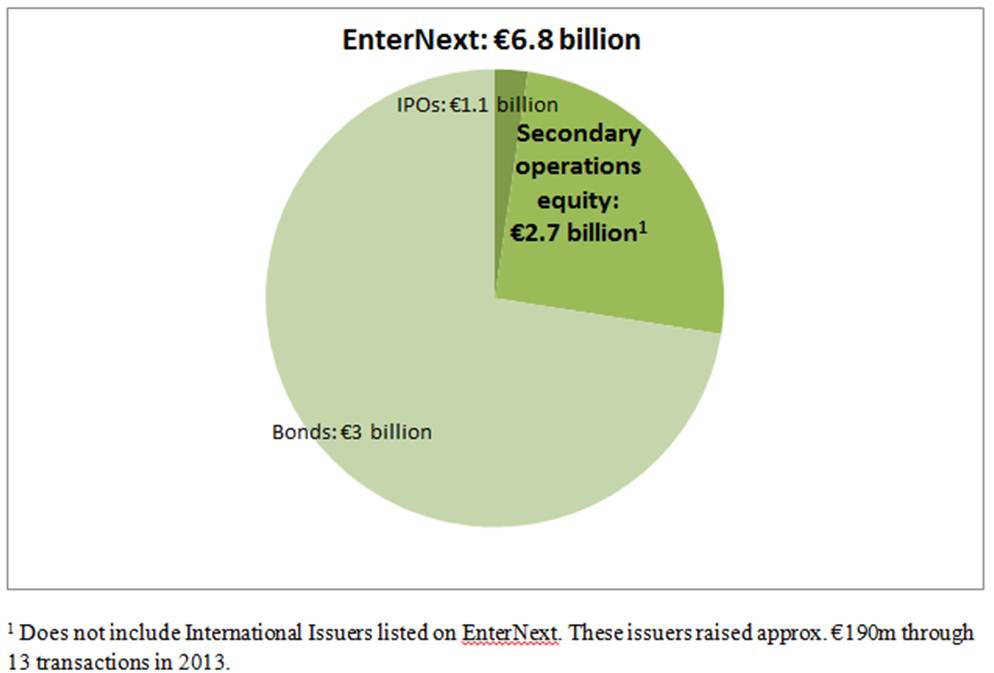

Companies listed on Euronext and EnterNext raised €92 billion in 2013, including €81.9 billion on Euronext – Compartment A and €6.8 billion on EnterNext, the new pan-European marketplace dedicated to SMEs1.

Five most important capital raises on Euronext – Compartment A in 2013

Date

Issuer

Operation

Amount Raised (€million)

17 May

KPN KON

Cash issue following a public offer

4 766

3 Jun

ASML Holding

Private Placement

2 296

14 Jan

ArcellorMittal

Private Placement

1 340

9 Dec

Alcatel-Lucent

Cash issue following a public offer

956

23 Dec

Royal Dutch Shell

Stock Dividend

949

Five most important capital raises on EnterNext in 2013

Date

Company

Operation

Amount Raised (€million)

5 Dec

CTT Correios Portugal

IPO with capital raised

579

24 Apr

Belvédère

Issue reserved to dedicated person

347

25 Nov

Nieuwe Steen

Private Placement

345

17 Dec

Caixa Economica Montepio Geral

IPO with capital raised

200

28 May

Vivalis

AP with capital raised

134

-

766290b6f99b-8328-4f4e-a0e0-1d764dfd8c25

London Newsbites

Norbert Dentressangle bets on a dual listing in London and Paris

Norbert Dentressangle, a major European transport, logistics and freight forwarding company, entered Euronext’s London market on 4 July 2013. This is a dual listing for Norbert Dentressangle which is already listed on the Exchange’s Paris market. To celebrate Norbert Dentressangle’s first day of trading on Euronext London, Chief Executive Officer, Hervé Montjotin, rang Euronext’s European market Opening Bell at the Exchange’s London office.

Hervé Montjotin CEO of Norbert Dentressangle said: “This event represents an important step in the growth of our company. It will help to diversify and expand our shareholder base by giving us access to Euronext’s extensive network of London-based institutional investors, and will position Norbert Dentressangle as a leading international, transport, logistics and freight forwarding company. We also believe our listing on Euronext London will raise the profile of Norbert Dentressangle amongst the UK investment community who have a wealth of experience in the transport, logistics and supply chain sector, and a good understanding of the key business attributes required to succeed in this highly competitive and increasingly global marketplace.”

Contacts

Albert Ganyushin (Director International Listings, Euronext)

Tel. +44 20 7379 2560

AGanyushin@euronext.comThomas Le Doeuff (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 13 92

tledoeuff@euronext.comFrédéric Martineau (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 13 11

fmartineau@euronext.comNathanael Mauclair (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 11 56

nmauclair@euronext.comExpertLine: +44 20 73 77 35 55

For more information or for specific questions, please contact your Account Manager or send an email to MyQuestion@euronext.com.

-

7661080fa9bc-a531-4902-84b5-8223294951ee

Save the date! The Pan-European IR conference, 23 and 24 September, in Brussels

The next Pan-European IR conference will be held in Brussels on 23 and 24 September and will bring together delegates from the IR associations of the Netherlands (NEVIR), France (CLIFF), Belgium (BIRA) and Portugal (FIR), as well as from Germany, Switzerland and other European countries.

The 2014 conference, organised by these four associations, as well as Euronext and Tradinfo, will be the largest event ever for the European IR community helping you to extend your knowledge of current topics and leading IR practices. In addition, there will be ample opportunities to exchange and share experiences with peers and industry experts and to enhance your career through collaborative learning, leading edge content, and unparalleled networking opportunities.

The success of the Pan-European IR conference is due to the program being set up by IROs for IROs. The theme of the conference and the topics for each of the sessions will therefore be proposed by the IR associations themselves.

The conference will kick off with an exclusive dinner event in the Palais de la Bourse, which will include an entertaining keynote address delivered by a well establised speaker. In addition, during the evening we will celebrate together with Thomson Reuters Extel the annoucement of the winners of the 2014 IR awards for Belgium, France and Portugal.

The following day we will start with the Opening Bell Ceremony by the IR Presidents, followed by three extensive and interactive parallel sessions, with a focus on sharing experiences through ‘best practice’ or ‘case study’ presentations. The networking lunch will be organised as an introduction to the sector approach in the afternoon sessions. Each of the standing tables will indicate a sector, so that the IROs have the opportunity to meet their counterparts in an informal setting.

In the afternoon, there will be around six parallel sector breakout sessions, specifically designed around the topical issues in specific industries. This set-up guarantees a customized approach tailored to the interest of the IROs. In addition, there will be also a parallel generic breakout session, in case an IRO does not want to join one the sector sessions. The event will end with drinks.

The website ‘Pan-European IR Conference’ will be updated in a few weeks. Registration will start in March at https://www.european-ir-conference.com.

We look forward to welcoming you!

-

7660db6d3b2e-9d25-44d3-a421-4ae28aeb98ba

The stock exchange requires greater discipline, in terms of transparency and strategy definition

Portuguese postal group CTT successfully entered Euronext Lisbon on 5 December 2013. The CEO of CTT, Francisco Lacerda, discusses the operation and explains the benefits of listing.

What was CTT’s goal in listing on the stock exchange?

The main reason was for the Portuguese state to fulfil the conditions of the privatisation programme set out in the financial aid plan negotiated with the European Union and the International Monetary Fund in May 2011. Previously wholly owned by the state, CTT was among the list of assets that Portugal had agreed to sell. We also needed to acquire a shareholder base that would be capable of supporting the group’s future.

Are you satisfied with investor response and the results of the operation?CTT’s introduction on the market on 5 December 2013 was undeniably a success. The introductory price of €5.52 per share was set in the upper range of the price spread considered, so the Portuguese government, which sold 70% of the capital of CTT, took in nearly €580 million – a good sign of investor enthusiasm. Institutional investors acquired 80% of the shares sold on the market, and thus hold 56% of our capital. The remaining 14% of capital was reserved for individual investors, including the group’s employees who benefited from preferential pricing at €5.24. The security has remained strong since the first day of listing and currently sells above its introductory price.

Is your presence on the stock exchange likely to influence your strategy?Our dialogue with investors will probably have an influence on the group’s strategy. However, this is not a current concern. Our strategy was redefined before entering the market, and it is on this basis that we presented ourselves to investors. It would not be reasonable to revise it today. We will thus continue our efforts to generate cash flow via a multi-product strategy (mail, financial services) and a generous dividend distribution policy. We are committed to pay €60 million in dividends in 2014, or a distribution rate of our net profits of at least 90%.

What benefits do you think you will gain from this listing, and what advice would you give another company planning to enter the stock exchange?Listing on the stock exchange gives us broader access to capital, which is clearly an advantage for the group’s development. It also has a more subtle, and I think positive impact, by requiring increased discipline, in particular in terms of transparency but also in strategy definition and implementation. And this is the advice I would offer a candidate for listing: develop a clear, coherent and realistic strategy that can be used to present extremely structured messages to investors. The experience has been a very positive one for us.

-

765965d505f5-237e-4737-a905-e5c6c0166e66

European Smallcap Event in Paris on 7 and 8 April 2014

Euronext will host the next European Smallcap Event organized by CF&B Communication on 7 and 8 April 2014 at the Pullman Tour Eiffel Hotel. Every year, this Euronext-sponsored event brings together some fifty companies listed on Euronext’s French, Belgian, Dutch and Portuguese markets, along with institutional investors, fund managers and financial analysts. The listed companies take part in workshops and seminars run by experts from throughout the euro zone, and enter into one-to-one discussions with the participating investors.

Register at: info@midcapevents.com

-

766546c3a6f4-e575-4901-944a-68f97edcc43e

Eric Forest: “The stock market is neither too complex nor too demanding for SMEs”

In May 2013, NYSE Euronext announced the launch of EnterNext, the new pan-European marketplace dedicated to SMEs.

In May 2013, NYSE Euronext announced the launch of EnterNext, the new pan-European marketplace dedicated to SMEs.

CEO Eric Forest takes a look at the specific needs of this category of companies and at EnterNext’s goals.What is the role of EnterNext?

EnterNext was created with the purpose of helping small and medium-sized companies (SMEs) find alternative sources of financing. Our role is to assist companies listed on compartments B and C of Euronext or on Alternext – companies with a market valuation of less than one billion euros – to make better use of the market, as well as to help unlisted companies prepare for possible entry on the stock exchange. It is also crucial to promote these companies among investors, and more generally to activate the entire ecosystem in seeking solutions to the challenges of financing their growth.What are the specific needs of SMEs with regard to the stock exchange?

SMEs today need alternatives to bank loan financing. Loans have become harder to obtain with the recession and new bank equity regulations which allows the stock market to reassert its role. The market environment is also more favourable today. The launch of the SME stock savings account (the French Plan d’épargne en actions dedicated to SMEs), for example, will “fuel” our market by drawing more savings to investment in small and medium-sized companies, enabling these to strengthen their equity.What are your goals?

We target the listing of 80 new companies per year in the four Euronext markets (Paris, Brussels, Amsterdam and Lisbon) by 2016. In 2013 there were 26 new entries in the market. This reflects an upward trend from the 16 new listings in 2012. It is important to point out the acceleration of this trend, with half of these operations completed in the final quarter of the year. Our second goal is to significantly increase the volume of funds raised in equity and bonds for the companies that form our target group. And most broadly, we aim to position the stock market as a source of financing for SMEs.What obstacles do you anticipate?

We must fight preconceptions and recall to mind a few truths by explaining things clearly and educating company executives. No, turning to the stock exchange is neither too complex nor too demanding. You have to learn to use it. No, smaller securities are not at a disadvantage in terms of performance, on the contrary! While the French CAC 40 index has risen 24% in ten years, the CAC Mid & Small index has registered growth of 130%. And no, issues of liquidity of smaller stocks should not be seen as inevitable. Liquidity must be understood as the ability for an investor to enter or exit the market at the desired moment. Company executives therefore have a role to play: the company must interest and be interested in the market over the long term, which is achieved through active marketing of its security.

Mentalities are changing, and one very encouraging point of note is the return of institutional and individual investors to small and medium-sized stocks. This is apparent in the success of the latest operations on our markets, which generated a level of demand such as we have not seen for several years.

-

7657614b64ec-9761-4ab2-aa93-f30476e58853

Euronext’s key role in financing European companies

For Euronext, 2013 will be remembered as the year our markets returned to business as usual. Although the economic environment remains challenging in many European countries, Euronext’s markets played a major role in financing companies of all sizes in every sector. Companies raised €92 billion in 2013 on our markets, compared with €83 billion the previous year, including €29.4 billion in equity and quasi-equity and €62.3 billion in bonds. The largest operations included Numéricable’s that raised €750 million with its IPO in Paris, as well two other French operations: Alcatel Lucent’s €1 billion capital increase and EDF’s €1.4 billion bond issue. In Belgium, bpost raised €812 million with its IPO and in PortugaVEl, postal operator CTT raised nearly €580 million early December when it entered the market in Lisbon. In Amsterdam, we had the interesting OCI technical listing (listing and exchange offer of € 6.2 billion Market Cap).

Nearly forty new entries on the market were completed last year, including more than 20 IPOs which raised in excess of €3 billion, a level of financing that had not been achieved since 2007.

“These figures and operations testify the central role played by Euronext in the financing of the European economy. We work constantly to increase transparency, efficiency and security while monitoring our markets in order to attract investors to the exchange and support business growth,” said Marc Lefèvre, Director, Head of European Business Development & Client Coverage, Euronext. “It can be said that a positive sentiment and momentum is back on our Markets.”

There are several reasons for this successful development. Firstly, investors and individuals in the market have been reassured by rising indices following several years of recession. The CAC 40 rose 17.99% in 2013, the AEX 17.24%, the BEL 20 by 18.10% and the PSI 20 by 15.98%. At the same time, volatility has dropped to low levels, which is necessary for a dynamic market of new introductions on the exchange. The VSTOXX volatility index which had risen to almost 60% in 2009 dropped to 17% at the end of 2013, the same level as before the recession in 2007.

Among the reasons for the exchange’s return to centre stage is a dual redistribution between stocks and bonds in favour of the former on the one hand, and geographically between the United States and Europe with the latter in particular thriving. The valuations achieved also enable investment funds to sell some of their holdings via listings on the market.

After a very encouraging 2013, Euronext is expecting a confirmation of these trends in 2014.

-

7656f0bda340-f0eb-404b-a3ff-ccc5ab909e0a

New Listings

New listings during S2 2013 on Euronext

Date

Company

Activity

sector

Operation

Amount raised

Capitalisation*

4.07

Norbert Dentressangle

Transportation

Dual listing

0

€605 M

5.07

Orège

Waste services

Global offering

€20.1 M

€57.7 M

5.07

Cardio3 BioSciences

Biotechnology

Global offering

€23 M

€101.9 M

10.10

BTG Pactual

Banking

Transfer from Alternext

0

-

30.10

Blue Solutions

Energy storage

Global offering

€41.8 M

€418

8.11

Numéricable

Broadband services

Global offering

€750 M

€3 530 M

22.11

Tarkett

Floor solutions

Global offering

€461 M

€1 800 M

25.11

Implanet

Medical techology

Global offering

€14.1 M

€39 M

25.11

Viohalco

Metal industry

Merger transaction

0

€920 M

29.11

Medtech

Medical technology

Global offering

€20 M

€64.5 M

12.12

SnowWorld

Leisure industry

Reverse takeover

0

€5.1 M

17.12

Montepio

Banking

Participation units

€200 M

€196 M

The CEOs comment their operations:

Hervé Montjotin CEO of Norbert Dentressangle: “We believe our listing on Euronext London will raise the profile of Norbert Dentressangle amongst the UK investment community who have a wealth of experience in the transport, logistics and supply chain sector.”

Pascal Gendrot, Co-founder and CEO of Orège: “Listing represents a major step ahead in our company's business development, and is clearly a springboard for structuring new strategic partnerships.”

Christian Homsy, CEO of Cardio3 BioSciences: “It is with great pride that we announce our listing in Brussels and in Paris. We are the first biotechnology company to list on both exchanges and welcome our new investors both institutional and private individuals.”

João Dantas, Executive Officer and Investor Relations Officer of BTG Pactual: “This transfer is a testimony to our continued cooperation with Euronext in Europe.”

Vincent Bolloré, Chairman of Blue Solutions: “After twenty years of hard work and R&D, our teams at Blue Solutions, with their unique expertise and know-how, are immensely proud to see their work listed on Euronext in Paris.”

Eric Denoyer, Chairman and CEO of Numericable Group: “Thanks to listing on Euronext and this capital increase we will be accelerating our investments over the next three years to strengthen our existing lead.”

Michel Giannuzzi, Head of Tarkett’s Management Board: “Today, Tarkett benefits from all of the strengths necessary to pursue its profitable, sustainable growth dynamic: a healthy, solid financial structure, a balanced geographical presence and a broad portfolio of solutions in the flooring and sports surface markets.”

Ludovic Lastennet, CEO of Implanet: “I am very happy with Implanet’s successful listing on Euronext where the number of health stocks has grown steadily and expanded its reach with international investors.”

Jacques Moulaert, Vice-president and Executive Director of Viohalco: “We strongly believe that Viohalco’s listing in Brussels today will boost its visibility and enhance its access to international capital markets.”

Bertin Nahum, Chairman & CEO and founder of Medtech: “I would like to thank all of the institutional and individual shareholders that have joined us, as well as all of our staff and partners, for their contributions to the success of our IPO.”

Koos Hendriks, CEO of SnowWorld: “The listing on Euronext Amsterdam is the basis of our ambition to realize the roll out of the SnowWorld concept in Europe.”

António Tomás Correia, Chairman of Montepio: “It is the first time that Montepio has equity capital listed on a stock exchange. It is a matter of great satisfaction for us and it establishes and strengthens our confidence in the future, taking into account the high number of subscribers - more than 25,000 - which shows the power of the brand”.

New listings during S2 2013 on Alternext

Date

Company

Activity

Sector

Operation

Amount raised

Capitalisation*

2.09

Medical Device Works

Medical equipment

Private placement

€2.5 M

€11.5 M

13.11

RocTool

Industrial machinery

Transfer from the Free Market

€3.6 M

€24.7 M

9.12

Entreprendre Lafont Presse

Publishing

Transfer from the Free Market

0

€25.4 M

17.12

Carbios

Green chemistry

Global Offering

€13.1 M

€52.4 M

23.12

Figeac Aéro

Aerospace

Private placement

€17.6 M

€244.5 M

The CEOs comment their operation:

Hervé de Kergrohen, CEO of Medical Device Works: “Our technology - a unique approach designed to treat liver cancer more effectively by repeated isolation of the organ - has been developed with the support of our traditional shareholders and clinical partners. It will now benefit from the visibility offered by stock-exchange listing."

Alexandre Guichard, Chairman of RocTool: “Our transfer to Alternext and related capital increase have boosted RocTool’s credibility and will enable us to pursue a growth strategy focusing on international markets.”

Robert Lafont, Chairman and CEO of Entreprendre-Lafont Presse: “Our transfer to Alternext opens a new stage in our experience on the stock market. In today’s economy, it not only boosts our credibility, it also gives us the clout and support we need to face the new challenges in our sector.”

Jean-Claude Lumaret, Carbios CEO and founder: “Our successful listing gives us the resources we need to become a leading player in the world’s plastics and recycling markets.”

Jean-Claude Maillard, Chairman and CEO of Figeac Aéro: “The increased financial resources that result from this listing will allow us to step up the pace of growth and above all to deploy our strategy aimed at becoming a world leader in subcontracted services to the aerospace industry.”

-

7654ebb05f2f-8114-46ee-ace3-a29fa7496be5

The Euronext bond offer: tailor-made financing solutions for all companies

European companies raised €62.3 billion in bonds (including convertible bonds) on Euronext’s European markets in 2013. This success is evidence of investor appetite for corporate credit in an environment of historically low interest rates. It is also based on Euronext’s many innovative offers to support the transformation of traditional financing circuits, with Euronext’s bond offer segmented today to satisfy the needs of companies of all sizes, from the largest to the smallest.

“There are many advantages to a bond offer. Companies can diversify their financing sources and reduce their dependency on bank financing. No dilution for the shareholder, historically low rates, long maturity, no or few covenants... issuers have much to gain from turning to the bond market. At the same time, these offers also enable investors to benefit from all the advantages of a regulated or self regulated market: liquidity, transparency, security, efficiency and credibility”, says Marc Lefèvre, Director, Head of Business Development & Client Coverage Europe, Euronext.

Large companies thus have access to a broad range of solutions based on their desired criteria (investor, format, maturity, currency, etc.):

- Eurobonds. These enable the issuer to turn to European institutional investors via syndicated investment in the bond market. Companies must first obtain a credit rating. Euronext’s straightforward, long-term and transparent infrastructure has supported the strong growth of this product in recent years.

- Euro PP. Launched in 2012, euro private placement bonds (Euro PP) allow mid-cap companies to to issue bonds with qualified institutional investors, in particular insurers. Private placement benefits from a specific legal framework and a format tailored to the companies concerned. This long awaited investor tool is also an efficient response to banking disintermediation.

- Retail bond offer. This allows a company to access the institutional and individual investor markets to expand its financing possibilities and increase its visibility with a loyal target group. Ratings are not required for large companies.

SMEs have access to Euro PPs and retail investors (Initial Bond Offering – IBO); this latter offer, launched in 2012, allows listed and non listed companies to turn to institutional and individual investors via a public offer on the regulated (Euronext) or self regulated (Alternext) market using a centralization process similar to that involved in an IPO. Ratings are required for listed SMEs with market capitalization of less than €100 million, and for non-listed companies1.

“Demand from institutional and individual investors is strong for these quality bond products that offer attractive returns and meet today’s prudential standards. Euronext’s expansive bond offer is part of our major effort to redirect investor savings towards productive investment,” says François Houssin, Head of Client Coverage France for Euronext.

1 For non-listed companies which follow the criteria of the European SME definition.

-

76537dcedde4-1a1a-446f-9961-b79335570bf3

Lisbon Newsbites

IPOs are back in force in Lisbon

IPO activity was intense in Lisbon in 2013. Nexponor “opened the market” in June with an Alternext listing by raising €65 million in new equity. However, it was December that tipped the scales with two IPOs and one technical listing:

-

5 December: CTT Correios de Portugal listed on Euronext after the government sold a 70% stake: 14% to retail and 56% to institutional investors. Over 25,000 investors bought CTT shares in what was the largest IPO in Portugal since 2008.

-

12 December: German-based HQ Life listed on Easynext Equities. This private equity company was the first to list on this market since 1999.

- 17 December: Caixa Económica Montepio Geral raised €200 million in participation units. Roughly 25,000 retail investors, all Montepio clients, subscribed to these innovative equity instruments.

Contacts

Miguel Geraldes (Head of Listings, Euronext)

+351/21 790 0062

mgeraldes@euronext.comPedro Wilton (Senior Account Manager, Euronext)

+351/21 790-0102

pwilton@euronext.comExpertLine: +351/21 790-0055

For more information or for specific questions, please contact your Account Manager or send an email to MyQuestion@euronext.com.

-

5 December: CTT Correios de Portugal listed on Euronext after the government sold a 70% stake: 14% to retail and 56% to institutional investors. Over 25,000 investors bought CTT shares in what was the largest IPO in Portugal since 2008.

-

7652b8213156-9487-40b4-9c16-e942305b7835

Paris Newsbites

A new SME stock savings account to boost the small- and mid-cap segment

A boost for small and medium-sized companies: this is the goal for the new SME stock saving accounts (PEA PME) that will be launched in France at the beginning of this year. Benefiting from the same tax advantages as traditional stock saving accounts (PEA), this new form of saving accounts must have 75% of securities being SMEs, half in stock, without exceeding €75,000. Eligible companies will be those with fewer than 5,000 employees and a turnover of less than €1.5 billion, or total assets inferior to €2 billion. Professionals estimate that this new product will be able to attract one to two billion euros – a most welcomed addition of financing for small and medium-sized companies that sometimes might struggle to get enough support.

Asset managers show strong interest for these new saving accounts. “This innovation expands the investment radar in favour of small and medium-sized companies,” says Diane Bruno, manager at Mandarine Gestion. “By offering a new opportunity for tax savings, the PEA PME could interest people whose existing stock account has capped out.” Investing in PEA PME would not lead to sacrifice any performance. “Small and mid-caps have been outperforming structurally since 2000”, notes Diane Bruno. A large majority of management companies are therefore expected to create funds that qualify for this new PEA.

To assist the Management companies, Euronext is preparing to launch a PEA PME index developed together with Société Générale. “We very much want to support the small and mid-cap compartment. Our initiative will supplement and buttress EnterNext’s efforts in this area”, says George Patterson, Euronext index manager. “Creating a benchmark will support this listing segment, as well as respond to a demand from professionals.” This index, initially limited to France and containing around forty securities, will meet PEA PME eligibility criteria as well as its liquidity criteria, with a required minimum of €250,000 in daily transactions. Further on, a pan-European index is in the pipeline.

Renewed strength of the Parisian markets in 2013

Euronext Paris played a major role in financing the French economy in 2013. Companies listed on our markets raised €64.3 billion last year, including €10.5 billion in equity and €53.7 billion in bonds. Moreover, unlisted companies also benefited from Euronext’s dynamism and listed numerous bond issues on our markets.

A total of 26 companies entered Euronext or Alternext Paris, compared with 19 in 2012 (+37%), representing an additional market capitalization of €80 billion, with €72bn coming from cross-Atlantic dual listings of Infosys and Eli Lilly. Around 20 of these operations were accompanied by public offers raising a total of €1.3 billion (a growth rate of more than 400% compared to 2012). One of these issuers was Cardio 3 Biosciences that became the first company to successfully list and raise money in Paris and Brussels simultaneously.

The three largest primary capital raisings on Euronext were Numéricable (€750 million), Tarkett (€462 million) and Blue Solutions (€42 million), all three taking place in the fourth quarter. On Alternext, the largest operations were Figeac Aero (€18 million), Carbios (€13 million) and Spineguard (€8 million) and Spineway (€5 million).

Contacts

Joseph Brigneaud (Business Development and Client Coverage Manager Rhône–Alpes & Auvergne regions, EnterNext)

Tel. +33 (0)4 72 40 56 97

jbrigneaud@euronext.comJean-Baptiste Celard (Business Development and Client Coverage Manager West and East regions, EnterNext)

Tel. +33 (0)1 49 27 50 38

jbcelard@euronext.comNicolas-Gaston Ellie (Business Development and Client Coverage Manager South-West region, EnterNext)

Tel. +33 (0)1 49 27 11 22

ngellie@euronext.comEric Forest (Chairman and CEO, EnterNext)

Tel. +33 (0)1 49 27 10 78

eforest@euronext.comFrançois Houssin (Head of Client Coverage France, Euronext)

Tel. +33 (0)1 49 27 12 65

fhoussin@euronext.comStéphane Laskart (Business Development and Client Coverage Manager West and East regions, EnterNext)

Tel. +33 (0)1 49 27 10 31

slaskart@euronext.comMarc Lefèvre (Head of European Listings Clients & Business Development, Euronext)

Tel. +33 (0)1 49 27 10 87

mlefevre@euronext.comGuillaume Mordelet (Business Development and Client Coverage Manager Mediterranean Area, EnterNext)

Tel. +33 (0)4 91 13 46 46

gmordelet@euronext.comGuillaume Morelli (Business Development and Client Coverage Manager SMEs, Ile de France and North regions, EnterNext)

Tel. +33 (0)1 49 27 12 98

gmorelli@euronext.comExpertLine:

Tel. + 33 (0)1 49 27 15 15

For more information or for specific questions, please contact your Account Manager or send an email to MyQuestion@euronext.com.

-

76512cd1774e-1633-464b-840b-75e917b03282

Brussels Newsbites

First European Advanced Therapies Biotech Investor Day

Euronext hosted and co-organised together with the Alliance for Advanced Therapies the first European Advanced Therapies Biotech Investor Day on 29 November 2013. Leaders of European advanced therapies companies met with investors, brokers, analysts and journalists to showcase the potential of new cell-, tissue-, and gene-based therapies and discuss investment strategies. Eduardo Bravo, Chair of the Alliance for Advanced Therapies, opened the European stock markets in Brussels with a bell ceremony commemorating the first meeting of its kind in Europe.

“Three European companies from the advanced therapies sector have gone public since the beginning of 2013, two of which on Euronext markets: Erytech Pharma (France) and Cardio3 BioSciences (Belgium). We anticipate that many more will follow in the coming years,” declared Vincent Van Dessel, Chairman and Chief Executive Officer of Euronext Brussels.

Belgian Investor Day in Zurich

Euronext hosted the first Belgian Investor Day in Zurich on 4 December 2013 in partnership with Bank Degroof. More than 80 one-to-one meetings were organised between Swiss professional investors and the 14 Belgian listed companies during this day of networking and conferences. Damien Petit, Bank Degroof Senior Economist, provided some perspective on the topic: “The Euro area, light at the end of the tunnel?”

Viohalco: the largest EnterNext listing in 2013

Viohalco, the holding company for a large metals group, celebrated its listing in Brussels on 22 November 2013. The reference price of Viohalco shares was €4.19 per share, valuing the company at €920 million at the listing date. “We are delighted with Viohalco's listing on Euronext Brussels and congratulate the company upon joining a community of over 160 other international issuers listed on our European markets.” said Alain Baetens, Head of Listings of Euronext.

Contacts

Alain Baetens (Head of Listings Belgium, NYSE Euronext),

+32/2 509-1279

abaetens@euronext.comExpertLine: +32/2 509-9595

For more information or for specific questions, please contact Alain Baetens or send an email to MyQuestion@euronext.com. -

76503fb4dc73-ad05-4772-a49d-536894a479e8

Amsterdam Newsbites

Unveiling of the “Amsterdam Exchange Experience” in the presence of her majesty Queen Maxima

Euronext presents the “Amsterdam Exchange Experience”, a new interactive and permanent exhibition about the role of the exchange in the local economy, developed with a view to financial education. On 6 November 2013, the exposition was opened during the centennial celebration of the Amsterdam exchange building in the presence of Her Majesty Queen Máxima. The Queen took part in a festive dinner with key clients and stakeholders where she spoke in her capacity as a member of the Committee for Enterprise and Finance and honorary chair of the Money Wise Platform. The Amsterdam Exchange Experience was opened to the public on 11 November.

Cees Vermaas, CEO of Euronext Amsterdam: “We are very proud of the opening of the Amsterdam Exchange Experience. The purpose is to make people aware of the importance of the exchange and its listed companies for the Dutch economy. In the Experience we explain the functioning of the capital market in an understandable manner”.

Those interested can register for the tours of the Experience on the website www.amsterdam-exchange-experience.com.

EnterNext welcomes SnowWorld

EnterNext, the Euronext subsidiary dedicated to promoting and supporting SMEs, welcomed the listing of SnowWorld on 12 December 2013. SnowWorld manages two indoor ski facilities and is one of the world’s leading companies in this industry. The company has grown rapidly since its foundation in 1996.

Cees Vermaas, CEO of Euronext Amsterdam declared: “SnowWorld is a good example of successful Dutch entrepreneurship. With the listing on Euronext Amsterdam a new phase will start for the company in which they can benefit from the exchange as a partner and alternative financing source.”

Koos Hendriks, CEO of SnowWorld said: “The listing on Euronext Amsterdam is the basis of our ambition to realize the roll out of the SnowWorld concept in Europe.”

Contacts

Hans Leufkens (Head of Business Development SMEs Netherlands, EnterNext),

+31/20 550-4687

hleufkens@euronext.comAnne-Louise van Lynden (Head of Listings Netherlands, Euronext),

+31/20 550-4107

alvanlynden@euronext.comExpertLine: + 32/20 550-4545

For more information or for specific questions, please contact your Account Manager or send an email to MyQuestion@euronext.com

-

Opkikker foundation sounds gong for new campaign

| Amsterdam

7672f674e419-be4a-46ef-8c4e-1391b99edfc5Opkikker foundation sounds gong for new campaign

The 8-year-old Jay-jay Willems experienced the day of his life thanks to the Opkikker Foundation. Together with the Ajax Foundation his dream of playing together with Ajax came true.

Besides being a cheerful boy of eight and Ajax at heart, Jay-jay is chronically ill. Via a tube in his stomach he receives almost one liter of medication every day. The disease has a huge impact on his daily life and his family. The Emma Children’s Hospital Jay - jay was signed at the Emma Children 'cheer.

Opkikker organizes special ‘Opkikker’ days for families with a chronically ill child. Jay-jay is the face of the new campaign in which the foundation calls attention to the need for these days for families with a sick child. The unique images of Jay-jay 's Opkikkerdag have been viewed more than a million times. The entire campaign was developed free of charge.

For more information: www.opkikker.nl

Amsterdam -

76716c79e16b-3b01-4e09-9a1f-cbb5e4f073f4

Espírito Santo Saúde rings the closing Bell

Espírito Santo Saúde CEO, Isabel Vaz, along with the board of the company, rang the closing bell in Lisbon to celebrate the Initial Public Offering (IPO) and the capital increase. With this operation, the ESS raised funds of approximately EUR 150 million, which will be used to finance its current activity and future investments.

Lisbon -

767099d984e6-ed49-42ec-8b96-dd5aaadcc960

Winners investment competition ‘Battle of the Schools’ sound gong

Students from the Olympus Collegefrom Arnhem sound the gong to celebrate their victory in the investment competition for schools.

The Battle of the Schools is an investment game for students and teachers in the upper classes of the secondary and advanced secondary school system. Students are divided into groups of three or four. Each group takes on the role of an investment advisor who is responsible for advising a family member, for example a father, mother or grandparent. The students are given a virtual capital of 100,000 Euros to invest in shares and investment funds listed on Euronext Amsterdam.

For more information: www.scholenstrijd.nl

Amsterdam -

DSM celebrates 25 years listing anniversary

| Amsterdam

76687722a2ad-07cd-464b-8a29-de9789bb325bDSM celebrates 25 years listing anniversary

By sounding the gong, DSM celebrates 25 years as a listed company on the Amsterdam exchange. DSM listed on 6 February, 1989.

DSM was mainly a petrochemical company and predominantly active in the Netherlands. Now, 25 years later, DSM is a global Life Sciences and Materials Sciences company with more than 200 locations worldwide and activities on five continents. In these 25 years, DSM’s share price has increased by more than 500%. DSM is represented at Euronext Amsterdam by a group of young managers, active in various functions, including Mergers & Acquisitions, Business Control, Operational Audit, Tax, Treasury, Production, Investor Relations and Communications. Investor Relations Manager at DSM, Marc Silvertand, sounds the gong.

For more information: www.dsm.com

Amsterdam