All Bell ceremonies

-

Capital Increase Parrot

| Paris

84243c5fc2fe-4b25-4e51-a80a-8a16725f55eeCapital Increase Parrot

Succesful capital increase on Euronext Paris

Henri Seydoux, founder, charmain & CEO of Parrot, opens the Euronext trading day in Paris

Founded in 1994 by Henri Seydoux, Parrot creates, develops and markets high tech wireless products for the retail and professional markets. The company operates in 3 main sectors: - Automotive, with the widest range of hands-free communication systems and infotainment solutions for the car, - Civil Drones (UAVs) through retail quadricopters and professional solutions - Connected objects, in the area of sound as well as gardening. Parrot, headquartered in Paris, currently employs over 900 people worldwide and generates the majority of its revenues outside of France. The company is listed on Euronext Paris (PARRO) since 2006 (compartiment B / midcaps)

Paris

Paris -

The Other Businessman

| Amsterdam

8421d5c778fd-0cc1-4ef7-984c-a3bf3432c416The Other Businessman

The Other Businessman sounds gong

The winners of ‘The Other Businessman 2015’ award visit Beursplein 5 and open the trading day. The election is an initiative of business club The Other Network.

Rodney Leysner has won ‘The Other Businessman 2015’ award for best multicultural entrepreneur in the Netherlands. Shurendy Gerardus was voted ‘The Other Manager 2015’, the best multicultural manager of the Netherlands. ‘The Other Businessman’ is sponsored by, amongst others, Euronext listed KPN.

Alderman Rabin Baldewsingh and presenter Diana Matroos presented the awards at the annual gala at Grand Hotel Huis ter Duin in Noordwijk. With the election The Other Network wants to give more visibility to successful multicultural business owners and managers, as well as encourage cultural diversity at the top of the Dutch business community. The Other Businessman award has been awarded for the tenth time.

For more information: www.theotherbusinessman.nl

Amsterdam

Amsterdam -

Listing on Alternext of Miliboo

| Paris

842093b643e6-c06c-432c-b36a-4178f4bf5e91Listing on Alternext of Miliboo

Guillaume Lachenal, CEO of Miliboo, closes the European trading day in Paris.

Established in 2005, Miliboo is a major player on the internet. Miliboo creates and sells flexible customized designer furniture and their speciality is their guaranteed delivery anywhere in France within 24 to 72 hours. The company declares turnover of €14.2M for 2014-2015, a year-on-year increase of 38%, of which 85% was generated in France and the other 15% in Europe.

Paris

Paris -

Kempen Orange Fund

| Amsterdam

8418277f212a-a94d-461f-b11a-44572d95a381Kempen Orange Fund

Kempen Orange Fund celebrates its 25th listing anniversary

Kempen Orange Fund celebrates its 25-year listing anniversary. Fund Manager Michiel van Dijk sounds the gong on this occasion and opens trading.

Kempen Orange Fund N.V. invests in smaller and medium-sized Dutch companies that are included in the GPR Dutch Small Cap Index. Kempen Orange Fund N.V. has the objective to earn a structurally higher return (capital gain and dividends) than its benchmark: GPR Dutch Small Cap Index.

During this quarter of a century, the investment fund has invested in small-cap and midcap companies listed on Euronext. Joop Witteveen, Fund Manager of the Kempen Orange Fund: ‘The Orange Fund is unique; not just because of its long history, but particularly because of the passion that is reflected in the investments of our people – then as much as today.’

For more information: www.kempen.nl/orangefund

Amsterdam

Amsterdam -

841975400250-0e58-4f89-8710-f39854f0ad36

Elia and Zetes celebrate 10th listing anniversary

Elia and Zetes celebrate 10th listing anniversary

10 years ago the company Zetes, implementing automatic identification and data capture systems for different steps in the supply chain and Elia, Belgium’s electricity transmission system operator, took their first steps on the Brussels Exchange. On December 15, 2015 both companies came back at Euronext Brussels to celebrate their 10th listing anniversary together.

Alain Wirtz , CEO of Zetes Industries and Chris Peeters, CEO of Elia rang the opening bell. Brussels

Brussels -

ING Private Banking

| Amsterdam

8417e0115dc1-d75a-44dc-8789-c807b775ac22ING Private Banking

ING Private Banking sponsors Dutch Golf Federation

ING Private Banking (ticker symbol: INGA) opens trading and announces the main sponsorship of Dutch golf. Golf professional Mark Reynolds sounds the gong.

By sponsoring ING Private Banking has an intensive cooperation with the Dutch Golf Federation with the aim to rejuvenate and renew the Dutch golf. The focus is on three priorities: boosting youth golf to generate growth in the future, stimulating top-level golf and encouraging innovation in the sport. ING Private Banking is both main sponsor of the Dutch Golf Federation (NGF), Golf Team Holland as well as a partner of the Ladies Open and the KLM Open.

ING is one of the largest and leading financial services providers in the Netherlands. ING is a global financial institution of Dutch origin offering services through its subsidiary ING Bank and has a significant interest in NN Group NV. The objective of ING Bank is to enable people to stay a step ahead, both in life and in work.

For more information: www.ing.nl/Private-Banking

Amsterdam

Amsterdam -

Xior Student Housing

| Brussels

8416ede1fd1e-a1bb-4b3c-9994-f5361bf9a572Xior Student Housing

Xior lists on Euronext Brussels

Brussels – 11 December 2015– EnterNext, the Euronext subsidiary dedicated to promoting and growing the market for smaller and mid-sized enterprises, today welcomed Xior Student Housing (ticker code: XIOR) on Euronext Brussels. With an issue price set at € 25, the Belgian real estate company raised € 88 million in new capital, reaching a total market capitalisation of € 116 million. The offer was 2.1x oversubscribed, with a strong demand from both Belgian retail investors and institutional investors in Belgium, Continental Europe and the United Kingdom.

Xior Student Housing NV is a Belgian property company specialising in student housing which offers a variety of accommodation, ranging from rooms with communal facilities to en-suite rooms and fully-equipped studios. Xior Student Housing is accredited as a public regulated real estate company (RREC) under Belgian law and has a property portfolio worth approximately € 196 million. With an average occupancy rate of 98%, Xior’s portfolio comprises over 2,000 rooms situated in major student cities in Belgium (Leuven, Ghent and Antwerp) and in the Netherlands (The Hague, Maastricht, Breda and Tilburg).

To mark the listing, Frederik Snauwaert, CFO of Xior Student Housing, rang the bell in Brussels to open trading.

Brussels

Brussels -

8412a60b78c0-432d-4652-81bc-e38b2fb14737

Think Morningstar® North America Equity UCITS ETF

Think ETF’s launches new ETF

Think ETF’s has launched a new ETF on Euronext Amsterdam. Aaron Renkers, fund manager at Think ETF’s, sounds the gong.

The Think Morningstar® North America Equity UCITS ETF tracks the performance of the Morningstar® North America 100 Equal Weight Index™, a newly created index consisting of 100 of the largest and most liquid stocks listed in the United States and Canada. Think ETF’s will meet requests from clients to offer more regional building blocks. Along with the Think European Equity UCITS ETF launched last October, this latest offering is the second regional ETF being offered by Think ETF’s.

Think ETF’s is the first Dutch provider of Exchange Traded Funds (ETFs). The company was founded in 2008 and launched its first ETF in 2009. Morningstar Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia.

For more information: www.thinketfs.nl

Amsterdam

Amsterdam -

Theam

| Paris

8415aa085b0e-8972-4e4c-b18d-a28a04bd1c6aTheam

Denis Panel, CEO of Theam closes the European trading day in Paris

Closing bell ceremony to celebrate a major change in the methodology used for its Low Carbon 100 Europe Index®.

Theam and Euronext pursue commitment to SRI with new version of its Low Carbon 100 Europe Index®. This new method is based on a more efficient means of measuring the energy performance of businesses, and offers investors a unique index-based solution.

Paris

Paris -

SnowWorld

| Amsterdam

8411ae03ad7e-cc3f-4f98-af78-257210050761SnowWorld

SnowWorld marks two-year listing

By sounding the gong, SnowWorld (ticker symbol: SNOW) marks its two-year listing anniversary on the Amsterdam Exchange. CEO Koos Hendriks sounds the gong.

The reverse listing in December 2013 did not only improve SnowWorld’s solvency, but also provided them access to the capital markets. The company has thus become less dependent on the future availability of bank credit for the execution of its strategy.

The process of the IPO and subsequent issue of new shares in February 2014 led to a further professionalization of SnowWorld. The introduction of a Supervisory Board has played an important role and SnowWorld has formulated a clear strategy. The implementation of this strategy will take place within a framework of risk management and corporate governance.

For more information: www.snowworld.com

Amsterdam

Amsterdam -

ICMA Future Leaders

| Amsterdam

8410811d096f-f3d4-4981-8316-91e8a3c928d1ICMA Future Leaders

ICMA Future Leaders event visit Beursplein 5

Henk Rozendaal, Chairman of the International Capital Market Association (ICMA) Netherlands regional committee, sounds the gong to open trading on the occasion of ICMA’s Future Leaders’ event in Amsterdam.

ICMA has set up an ICMA Future Leaders Committee, for individuals in the early stages of their career, to improve its engagement with the younger generation among its membership. ICMA places great importance on reaching out to younger finance professionals in its member firms not only to raise awareness of the Association’s work and the benefits they could reap from its services, but also to foster a sense of community.

ICMA is the only trade association to grow up alongside the development of the cross-border capital markets. Not linked to any one national market, ICMA has promoted the development of efficient global capital markets for close to 50 years. Its code of industry-driven rules and recommendations is followed by its members and sets the recognised standard for best practice in the primary, secondary and repo markets for international fixed income and related instruments. ICMA has some 500 member firms in almost 60 countries, including banks and financial institutions who are active in international capital markets.

For more information: www.icmagroup.org

Amsterdam

Amsterdam -

Verenigde Nederlandse Compagnie

| Amsterdam

84091b685cd2-3562-4084-af39-b3c060222718Verenigde Nederlandse Compagnie

Verenigde Nederlandse Compagnie opens trading

Verenigde Nederlandse Compagnie (ticker symbol: VNC) opens trading at the Amsterdam exchange by sounding the gong.

Geert Schaaij, the CEO of Verenigde Nederlandse Compagnie, formerly Roto Smeets, has symbolically launched a new listed investment fund by sounding the gong.

The fund has three clear objectives; all acquisitions should have positive cash flow, a clear business model and have a growth potential which can create value per share. The objective is also directed to a solid dividend policy.

For more information: www.vncnv.nl

Amsterdam

Amsterdam -

Deceuninck bonds

| Brussels

841410d007bd-301b-488e-901d-db5625519108Deceuninck bonds

Deceuninck celebrates bond listing at Euronext Brussels

Baron PierreAlain de Smedt, Chairman of Deceuninck, opens the European stock markets with a Bell Ceremony at Euronext Brussels to celebrate the listing of the bonds issued Deceuninck for an amount of 100 million euros, with maturity of 7 years. The coupon amounts to 3.75% gross per year.

KBC acted as general coordinator in this transaction.

To know more about Deceuninck, please click on the following link : www.deceuninck.com

Brussels

Brussels -

Sustainable Stock Exchange

| Paris

84134ccb472e-a638-4148-9bb2-875925162ee4Sustainable Stock Exchange

COP 21: Euronext joins the U.N. Sustainable Stock Exchange Initiative

Amsterdam, Brussels, Lisbon, London and Paris – 7 December 2015 – Euronext, the primary exchange in the Euro zone, today announced that it has joined the United Nations' Sustainable Stock Exchanges (SSE) initiative. The UN SSE initiative aims to explore how exchanges can work together with investors, regulators, and companies to enhance corporate transparency on Environmental, Social and Corporate Governance (ESG) issues and encourage responsible long-term approaches to investment.

This morning Eric Usher, Acting Head of the United Nations Environment Programme Finance Initiative (UNEP-FI), rang the opening bell at Euronext Paris to mark the occasion. He was joined by the Chief Executives of other exchanges participating in the initiative and by the Chief Executive of ESMA.

Euronext’s five market operators[1] have voluntarily committed—through dialogue with investors, companies and regulators— to promote sustainable, long-term investment and improved ESG governance disclosure and performance among the companies listed on their exchange.

In line with this initiative, Euronext continues to launch products related to the financing of the real economy in support of sustainability projects. These include:

- Green Bonds: where funds raised are used exclusively to finance eligible Green projects such as renewable energy, sustainable land use, clean transportation, etc. In 2015, €3.84bn have already been raised through 11 green bond issues.

-

Sustainable indices: Euronext is working with Vigeo, the European leader in assessing companies’ and organisations’ extra-financial practices and performance, including environmental, social and governance (ESG) issues.

In addition, in November 2015, Euronext launched a new version of its Low Carbon 100 Europe Index®in partnership with Carbone 4 and CDP,introducing a more efficient means of measuring companies’ energy performance. - Commodities:Euronext has launched a number of products dedicated to financing the real economy, and our commodity contracts for milling wheat, rapeseed, corn and other products have long been relied upon as trusted global and European benchmarks. In June 2015, Euronext announced the launch of a Wood Pellet Contractleveraging favourable legislation in renewable energy to provide its clients with a product that supports renewable energy initiatives.

Stéphane Boujnah, CEO and Chairman of the Managing Board of Euronext NV, declared, “Joining the SSE initiative and partnering with the UN and our industry is another milestone in Euronext’s support for best practices in the environmental, social and governance fields, as well as for corporate social responsibility. As the leading pan-European exchange, operating regulated markets in five countries in Europe, Euronext has a responsibility to create a productive dialogue between investors and issuers, and encourage issuers to communicate their efforts in corporate sustainability. We look forward to participating in the Sustainable Stock Exchanges initiative as a global forum for sharing best practices on capital markets.”

Paris

Paris -

BE Semiconductor Industries

| Amsterdam

84082020c85c-725f-471a-8d13-5d4d2b19db7aBE Semiconductor Industries

BE Semiconductor Industries celebrates 20th listing anniversary

BE Semiconductor Industries (ticker symbol: BESI) celebrates its 20th anniversary as a public company by opening trading on Euronext Amsterdam with the sounding of the gong.

Richard Blickman, CEO of Besi commented: “We are pleased to be here today to commemorate our initial listing as a public company 20 years ago. Since our inception as a public company in 1995, it has been an exciting journey as Besi has grown from being a local Dutch system and tooling manufacturer to become one of the leading semiconductor assembly equipment manufacturers in the world.’’

Besi is a leading supplier of semiconductor assembly equipment for the global semiconductor and electronics industries offering high levels of accuracy, productivity and reliability at a low cost of ownership. The company develops leading edge assembly processes and equipment for lead frame, substrate and wafer level packaging applications in a wide range of end-user markets including electronics, mobile internet, computer, automotive, industrial, LED and solar energy. Customers are primarily leading semiconductor manufacturers, assembly subcontractors and electronics and industrial companies.

For more information: www.besi.com

Amsterdam

Amsterdam -

8407db1fa58b-e1c3-469b-904c-e54d693febda

Real estate certificate ‘Immo Mechelen City Center’

Kim Creten, CEO of KBC Real Estate rings the bell to celebrate the first listing of the real estate certificate ‘Immo Mechelen City Center’ on Euronext Brussels. This is the first real estate certificate for private investors since 10 years.

Brussels

Brussels -

Business Walk of Fame

| Amsterdam

8403a5b8ffae-0384-4f4e-ada8-0aa988508a25Business Walk of Fame

Nominees Business Walk of Fame visit Beursplein 5

The Business Walk of Fame praises companies that are committed to an inclusive labour market. On World Disability Day, 3 December, the Lucille Werner Foundation announces the winners of the Business Walk of Fame 2015. Lucille Werner, in presence of the nominees, calls attention to the importance of an inclusive labour market by sounding the gong.

The Business Walk of Fame is a promenade of tiles on the Claude Debussylaan at Zuidas Amsterdam. Lucille Werner: ‘’In a time where companies are forced to think about this subject in regards to the law of participation, we want to show a positive stimulating project to reward the companies that have taken their first steps.’’ The jury has selected the nominees and winners from the applications. The jury consists of several representatives from the industry, government and interests groups, as well as last year’s winners.

For more information: www.lucillewernerfoundation.nl

Amsterdam

Amsterdam -

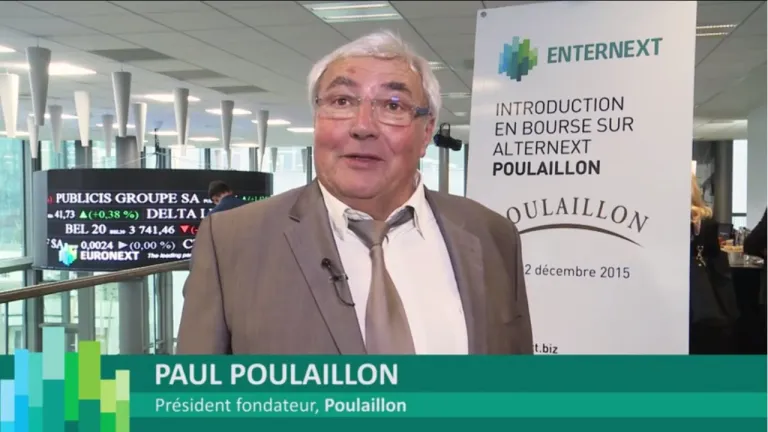

Poulaillon

| Paris

8406122bd838-3cb7-4bbd-a295-a221c4b36ec7Poulaillon

Listing on Alternext of Poulaillon

Poullailon opens the European trading day in Paris.

Poulaillon specializes in the manufacture and marketing of fresh and deep frozen bakery and pastry goods (breads, Viennese pastries, sandwiches, moricettes, mignardises, entremets, cakes, etc.). Besides, the company develops a catering activity.

At the end of 2014, products are distributed through a network of 35 stores located in France, and via hypermarkets, local retailers, the out-of-home dining, vending machines, etc. Paris

Paris