All Bell ceremonies

-

Gong marks start of ProBeleggen

| Amsterdam

78449d6d75a8-6271-4545-b45a-f8103c1d4cbbGong marks start of ProBeleggen

By sounding the gong online platform ProBeleggen is launched.

ProBeleggen.nl serves private investors and makes professional expertise publicly available, aiming to support private investors with their investment decisions. The online platform makes analyses and personal investment portfolios of proven professionals available for everyone and gives private investors a helping hand. Known and experienced experts like Jacob Schoenmaker and Jaap Koelewijn disclose their portfolios and decisions at the website. Initiator Albert Jellema sounds the gong.

For more information: www.probeleggen.nl

Amsterdam

Amsterdam -

7843f788d460-3f31-4d15-acf6-0285986c32c4

New CEO Willis Netherlands, Jeroen Everling, visits Beursplein 5

Jeroen Everling visits Euronext Amsterdam and sounds the gong in his capacity as the new CEO of Willis.

Everling: “I am looking forward to working with the various teams at Willis in order to build a successful future. I am also looking forward to meeting with Willis’s customers and prospects to discuss and exchange ideas about themes such as digitalisation, the disappearance of borders, and the fine tuning of legislation. We face new risks, such as cyber crime, climate, environmental issues and 3D printing. Organisations need to anticipate these changes and ask themselves questions such as: What are our risks and what is the impact? How well prepared are we to deal with an emergency scenario? Willis strives to maintain a stable level of growth over the next few years, and will explore opportunities for takeovers and expansion of the team.”

For more information: www.willis.com

Amsterdam

Amsterdam -

Mr Jacques Aschenbroich, Valeo CEO, rings the bell to open the European trading day in Paris

| Paris

78427adc411c-3e35-4547-9c17-c2b2a244341cMr Jacques Aschenbroich, Valeo CEO, rings the bell to open the European trading day in Paris

To mark Valeo's return to the CAC 40, Jacques Aschenbroich, Valeo CEO, rings the bell to open the June 23, 2014 trading session.

Paris

Paris -

78411bb247a4-0596-470e-ad7a-7c4b158215ab

The Royal Bank of Scotland celebrates the 10th anniversary of Turbo

The Royal Bank of Scotland (RBS) sounds the gong to celebrate the 10th anniversary of Turbo®.

Since its introduction ten years ago, the Turbo has become one of the most popular investment products for active, experienced investors. RBS, with a market share of 44% of the turnover in this product on Euronext Amsterdam in 2014, is the market leader in this segment. Erik Mauritz, who is responsible for Turbos at RBS, believes that the enduring success of the Turbo is due to transparent price formation, the range of products available, and the clarity of the information provided about the processing, cost and risk involved in trading Turbos.

For more information: www.rbs.nl

Amsterdam

Amsterdam -

A Euronext vai estar cotada! Em Amesterdão, Bruxelas e Paris no dia 20 de Junho de 2014

| Amsterdam, Brussels, Paris

783897fa2e4c-3c8a-4621-ac42-d81862b2a688A Euronext vai estar cotada! Em Amesterdão, Bruxelas e Paris no dia 20 de Junho de 2014

Rijnhard van Tets, Presidente do Conselho de Supervisão, e Dominique Cerutti, CEO e Presidente do Conselho de Administração, tocam o Sino e o Gongo na primeira cerimónia de abertura de mercado pan-europeia da Euronext.

A Euronext é um grupo de intercâmbio pan-europeu que oferece uma vasta gama de produtos e serviços e que combina equidade transparente, eficiente e regulada, títulos de rendimento fixo e mercados de produtos derivados em Paris, Amesterdão, Bruxelas, Lisboa e Londres. A atividade inclui: cotações, negociação financeira, negociação de produtos derivados, índices e dados de mercado, soluções de pós-negociação e de mercado.

Descarregue a foto: Amesterdão, Bruxelas, Lisboa, Paris

Amsterdam, Brussels, Paris

Amsterdam, Brussels, Paris -

Theodoor Gilissen Bankiers

| Amsterdam

78405ed3de6b-7bd4-44b2-8ccc-d6233e825434Theodoor Gilissen Bankiers

Equity analyst Tom Muller (68) of Theodoor Gilissen Bankiers is the oldest equity analyst currently working in the Netherlands. With 45 years' experience in the profession, he can justifiably be considered the most experienced equity analyst in the country.

Tom Muller sounds the closing gong at the Amsterdam exchange as part of a surprise celebration marking his 45 years in the profession. Tanja Nagel, CEO of Theodoor Gilissen, presents Tom with the cup for the most experienced equity analyst in the Netherlands, which has been designed especially for the occasion. Theodoor Gilissen is a private bank offering services in the areas of investing, financial planning and financing and has branches in Amsterdam, Eindhoven, Groningen and Rotterdam.

Amsterdam -

ETF Securities launches first ETF on MSCI China A with physical replication on Euronext Paris

| Paris

7836dc891cbf-e712-4049-aa85-e4ec25dfd8a8ETF Securities launches first ETF on MSCI China A with physical replication on Euronext Paris

ETF Securities partnered with E Fund, one of China’s largest asset management companies, to launch Europe’s first physically replicated UCITS exchange traded fund (ETF) tracking the MSCI China A Index. "ETFS-E Fund MSCI China A GO UCITS ETF" is denominated in EUR and listed on Euronext Paris as of today.

This ETF can serve as a tool in a strategic asset allocation; and can also allow investors to gain a tactical exposure to A shares where valuations are still very attractive.

The MSCI China A Index has the broadest and most comprehensive A share stock coverage, with strong historical outperformance compared to other A share benchmarks. Henri Boua, Associate Director for France and Monaco said: “ETFS-E Fund MSCI China A GO UCITS ETF aims to track the performance of the MSCI China A Index that comprises over 460 Chinese stocks and provides more diversified sector coverage than other China A indices which typically have a high concentration in fewer sectors and stocks.”

“ETF Securities is delighted to be working on this product with E Fund, the second largest RQFII Quota holder with approximately RMB27 billion. As one of China’s top asset managers, they have extensive experience in the industry, having previously launched China A Share ETFs in China.” Paris

Paris -

7830a573e96e-4878-42ee-87f7-0e5a216ad119

BAM marks 55th listing anniversary by sounding the gong

Member of the Executive Board of Royal BAM Group, Rob van Wingerden , marks the 55th anniversary of the BAM listing by sounding the gong.

Royal BAM Group shares have officially been listed on the stock exchange at Beursplein 5 in Amsterdam since 19 June 1959. The shares were provisionally included in the listing from the beginning of March 1959. ‘Very soon the shares of Bataafsche Aanneming Society formerly Fa. J van der Wal & Zoon N.V. will be introduced on the Amsterdam Stock Exchange’, wrote the daily newspaper Telegraaf on 18 February 1959. Meanwhile, BAM has more than 269 million shares outstanding and the total market capitalisation at the end of 2013 was just over €1 billion. Royal BAM Group has approximately 23,000 personnel members active in the construction and mechanical and electrical engineering, property and public-private partnership sectors.

For more information: www.bam.nl

Amsterdam

Amsterdam -

78379a2d3f15-f1b4-46fb-af1b-9163d4f25312

CFO of the Year rang the Opening Bell in Brussels

On 19 June 2014,Trends CFO of the Year, Karen van Griensven (Melexis), rang the Opening Bell on Euronext Brussels in the presence of some other nominees.

More about the3rd edition of CFO of the year

Brussels

Brussels -

78351093c443-7724-4ce3-bdbe-ee8ad19f0a4c

Mr Chabanel, new Chairman of AFIC, closes the European trading day in Paris

On the occasion of his election as Chairman of AFIC, Michel Chabanel rings the Closing Bell of the European trading day. This ceremony demonstrates the complementarity between Private Equity and financial markets for companies.

Paris

Paris -

7834462fea17-665e-4c23-af53-b129fe5a7f69

EnterNext welcomes Pixium Vision on Euronext in Paris

Bernard Gilly, Executive Chairman of Pixium Vision, rings the opening bell.

Pixium Vision specializes in developing electronic retinal implants. Products are for people having lost their sight due to degenerative eye disorders such as retinitis pigmentosa.

Paris

Paris -

7829f366f571-db8c-4860-92f8-ec93956aae76

Orange Babies sound gong for Mont Ventoux Expedition

Baba Sylla, the director the Orange Babies Foundation, sounds the gong to mark the start of the Mont Ventoux Expedition from 20 to 23 June of this year. He is accompanied by the director of DESTIL, Orange Babies’ partner and also the initiator of the Mont Ventoux Expedition.

On 22 June over 70 participants will run or bike up the Mont Ventoux. They face a daunting challenge on the mountain (elevation 1912m), which is known as the Giant of the Provence. The participants have found sponsors for 1, 2, 3 or 4 climbs up the mountain. Orange Babies will use the proceeds of the Expedition to finance a programme in Africa, which treats babies born with HIV. As was the case last year, the foundation has decided to invest in the Ng’ombe Home Based Care project. The goal of the project is to reduce the rate of mother-to-child HIV transmission in the slums of Ng’ombe, Zambia, from 10% to 2% by 2018.

For more Information: www.orangebabies.nl

Amsterdam

Amsterdam -

Bell Ceremony to celebrate the listing of the bond (Medium Term Notes) issued by Home Invest Belgium

| Brussels

7833d62c8276-44bf-4a78-a772-a295dc6982feBell Ceremony to celebrate the listing of the bond (Medium Term Notes) issued by Home Invest Belgium

On Wednesday 18 June 2014, Sophie Lambrighs CEO of Home Invest Belgium, opened the European stock markets with a Bell Ceremony at Euronext Brussels to celebrate the listing of the bond issued by Home Invest Belgium for an amount of 40 million euros. The coupon amounts to 3.79% gross per year.

Sophie Lambrighs CEO of Home Invest Belgium

Belfius acted as Sole lead manager in this transaction.

To know more about Home Invest Belgium, a residential REIT, please click on the following link : www.homeinvestbelgium.be

Brussels

Brussels -

7831042e5f0c-489c-4b3a-a805-3a9add523461

EnterNext welcomes Bluelinea SA on Alternext in Paris

Laurent Levasseur, CEO of Bluelinea SA, rings the opening bell.

Bluelinea SA specializes in designing and developing electronic surveillance and medical teleassistance systems. The group offers caregiver identification and authentication badges, individual protection bracelets for newborns, and home care and treatment devices for fragile or chronically ill elderly persons.

Paris

Paris -

78287cb75e2f-1146-4ffe-ba13-14d52a315c7f

International Corporate Governance Network visits Euronext Amsterdam

By sounding the gong, The International Corporate Governance Network (ICGN) marks the ICGN annual meeting, the world’s leading convention for the global corporate governance community, held between 16-18 June in Amsterdam.

ICGN is an investor-led organisation of governance professionals and ICGN's mission is to inspire and promote effective standards of corporate governance to advance efficient markets and economies world-wide. The conference programme features over 30speakers including Jeroen Dijsselbloem,Dutch Finance Minister of Finance and Eurogroup President, Jeroen Hooijer, Head of Corporate Governance, European Commission, Stéphane Hallegatte, Senior Economist, World Bank, Steven Maijoor, Chair, European Securities and Markets Authority and Anne Louise van Lynden, Head of Listing, Euronext Amsterdam. Managing Director Corporate Governance & Responsible Investment at BlackRock, Michelle Edkins and Executive Director at Eumedion, Rients Abma sound the gong.

For more information: www.icgn.org

Amsterdam

Amsterdam -

78327a9941e0-886a-4dd7-a1be-5f81fc670851

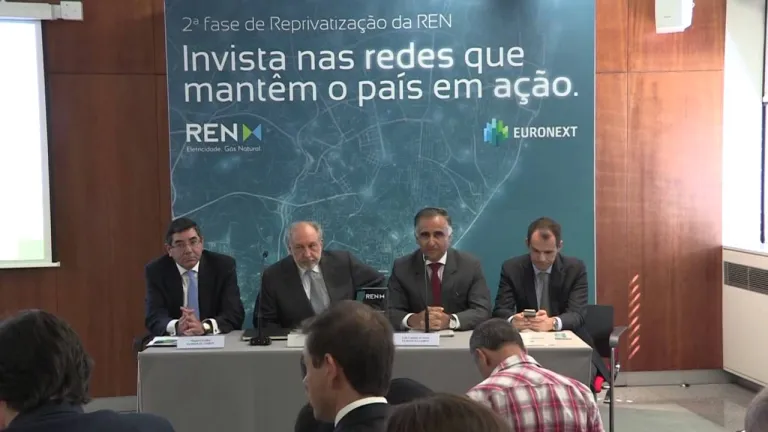

Ações da REN começam a negociar na Euronext Lisbon

Operação gera encaixe de EUR157 milhões

Lisboa – 16 de Junho de 2014 – A Euronext anunciou hoje que a venda dos 11% do capital social da REN-Redes Energéticas Nacionais, SGPS, SA ainda detidos pelo Estado Português, gerou um encaixe de EUR157 milhões.As 58.740.000 ações colocadas à venda serão admitidas à negociação no mercado regulamentado da Euronext Lisbon a 17 de Junho, permitindo aumentar o ‘free-float’ da empresa para 30%, comparativamente com os atuais 20%.

O preço da segunda fase de reprivatização da REN foi fixado em 2,68 euros. Asacções da empresa encerraram hoje a negociar nos 2,72 euros, o que significa uma capitalização bolsista de cerca de EUR1,5 mil milhões, considerando as 534 milhões de acções de capital social.

O Estado Português decidiu vender os restantes 11% que ainda detinha na empresa, liderada por Rui Vilar, através de uma Oferta Pública de Venda (OPV) no mercado nacional e uma venda direta institucional dirigida a investidores qualificados nacionais e internacionais.

Das 58.740.000 de acções disponíveis, 11.748.000 ações destinaram-se à OPV, incluindo 587.400 ações dirigidas aos trabalhadores e 11.160.600 ações dirigidas ao público em geral, e uma Venda Direta Institucional de 46.992.000 ações. Cerca de 1,7 milhões de acções da tranche relativa à OPV passaram para a venda direta institucional, que somou um total de 48.692.320 ações.

Após a OPV, a REN angariou 2.155 novos accionistas.

Luís Laginha de Sousa, Chairman e CEO da Euronext Lisbon afirmou: “É com profunda satisfação que registamos o sucesso da Oferta da REN, uma operação que realça a importância do mercado de capitais e da Bolsa Portuguesa, enquanto meio de suporte às Privatizações e aberto a todos os investidores". Acrescentou ainda: "O aumento do free float da REN, proporcionado por esta operação, é também um elemento positivo para o mercado globalmente considerado".

Emílio Rui Vilar, Presidente do Conselho de Administração e da Comissão Executivada REN, disse: “A total privatização do capital da REN, fecha um ciclo que se iniciou com a autonomização da função de transporte na cadeia de valor da energia. Hoje atinge-se a situação de total independência entre o concedente Estado e a concessionária REN, e portanto a conclusão do modelo institucional”. “Congratulo-me com o resultado da operação porque, para além de clara demonstração de confiança dos investidores, veio permitir o aumento do free float e da liquidez do título, o que é bom para os accionistas e um acrescido desafio para a gestão e para os trabalhadores da empresa”, adiantou.

Lisbon

Lisbon -

7827673581a0-ed6e-408e-93ef-fda1ef21e531

Four MENA Exchanges close Euronext Markets in Paris

Euronext hosted the CEOs of Amman, Beirut, Tunis and Muscat Exchanges. The CEOs closed Euronext European Markets in Paris.

Mr. Marwan Bataineh - Chairman of Amman Stock Exchange, Mr. Chadi Salameh - Beirut Stock Exchange, Mr. Mohamed Bichiou - CEO of Tunis Stock Exchange, Mr. Ahmed Al-Marhoon - Director General of Muscat Securities Market, along with Mr. Nick Thornton - SVP Global Head of Euronext Market Solutions closed the European trading day in Paris.

Euronext previously announced that it has successfully signed agreements with four exchanges in the Middle East and North Africa (MENA) region for the implementation of its new UTP solution, UTP-Hybrid.

Read the full press release: Euronext signs agreement on UTP implementation with four MENA exchanges (www.euronext.com) Paris

Paris -

7826c8fdd026-a190-449e-86fd-5f98178bd7f4

EnterNext welcomes Reworld Media on Alternext in Paris

Pascal Chevalier, CEO of Reworld Media, rings the opening bell.

Reworld Media specializes in publishing Internet sites for the general public dedicated to sustainable development.In addition, the company develops and sells content and animations for Web portals and implements sensitization means and tools for companies and local administrations.The company operates 2 websites: Developpementdurable.com (economic, social, environmental and political current events related to sustainable development) and GchangeTout.com (exchange of items and services between individuals via the Web).

Paris

Paris