2020 was an exceptional year in terms of volatility in Europe, reaching the levels of 2008 (measured by the CAC 40® Volatility Index or VCAC). Over the course of 2020 and 2021, volatility has remained higher than the average of the last five years.

As volatility increases, market quality deteriorates across all venues. However, analysis of this phenomenon is scarce, despite the fact that it is during highly volatile periods that market quality matters most for investors.

In this document, Euronext provides a short market quality analysis in order to tackle this lack of information, while opening the door for further research.

Euronext Equity Market Quality Analysis report

A short analysis, demonstrating that in times of heightened volatility, Euronext's equity market remains resilient and provides the best market quality for its listed stocks, and proving the benefits of Euronext’s liquidity schemes for investors.

Executive Summary

- Setting aside ‘black swan’ events such as March 2020, Euronext’s market quality remains resilient in periods of high levels of volatility compared to its main competitors.

- The deterioration in some metrics is far less on Euronext than on other venues.

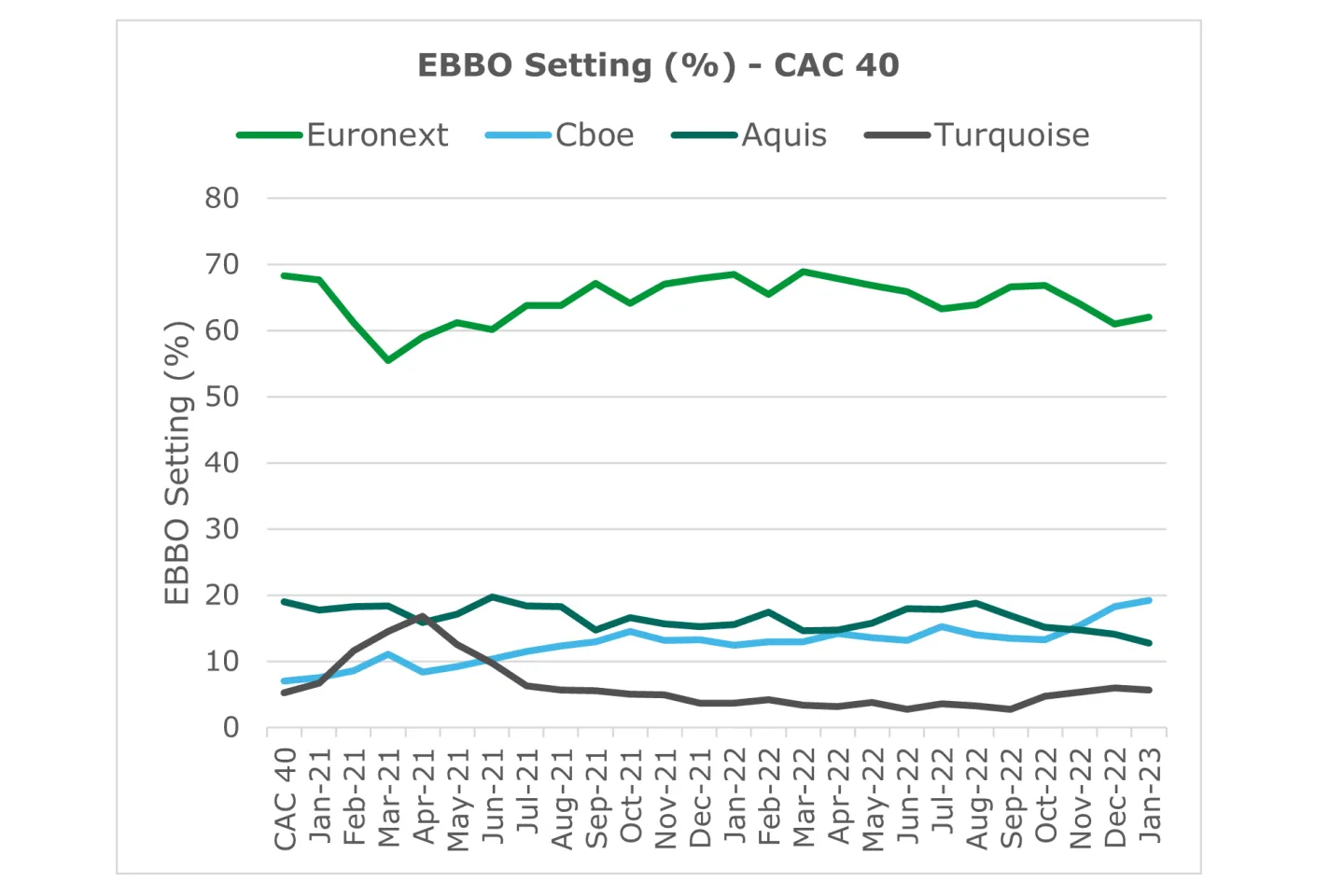

- The impact of volatility on EBBO Presence and Setting is less noticeable on Euronext.

- The analysis demonstrates the benefits of Euronext’s liquidity programmes and the importance of the requirements in place for clients.

Methodology

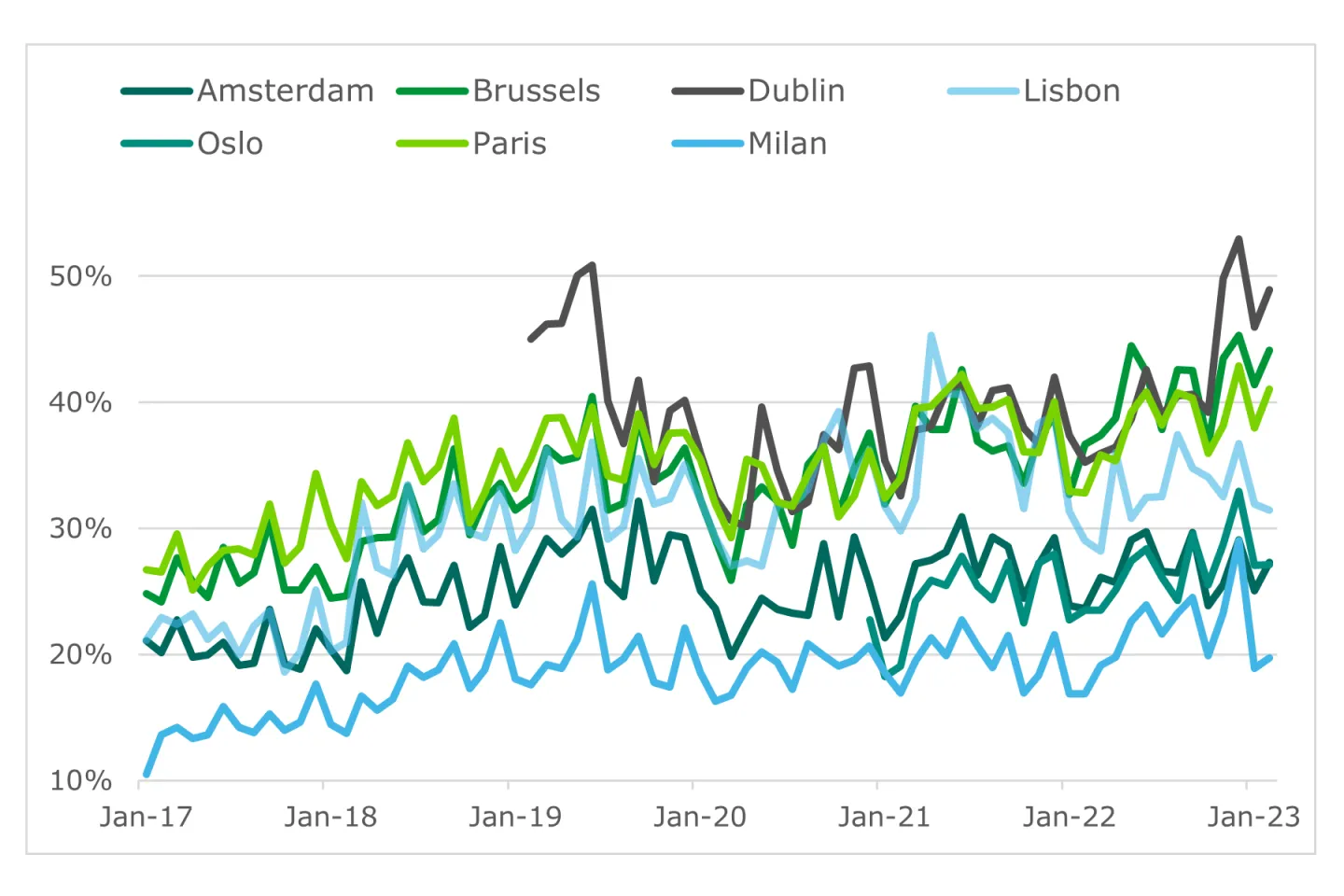

- In this analysis, we select a basket of liquid securities that are listed on the Euronext Markets. The basket is made up of the component securities of the CAC40®, AEX® and BEL20®, the national blue-chip indices for France, the Netherlands and Belgium. By selecting these securities, we exclude the potential impact of illiquid securities. The data covers the period from 1 January 2020 to 9 September 2021.

- The market quality metrics used in the study are provided by BMLL Technologies. Three main metrics are examined: Spread, Liquidity at Touch and Time Presence at the European Best Bid & Offer (EBBO).

- The BMLL market quality metrics are then compared with the average annualised intraday volatility per security using the Garman-Klass volatility formula. Three buckets of volatility are identified, to take into account different market conditions.