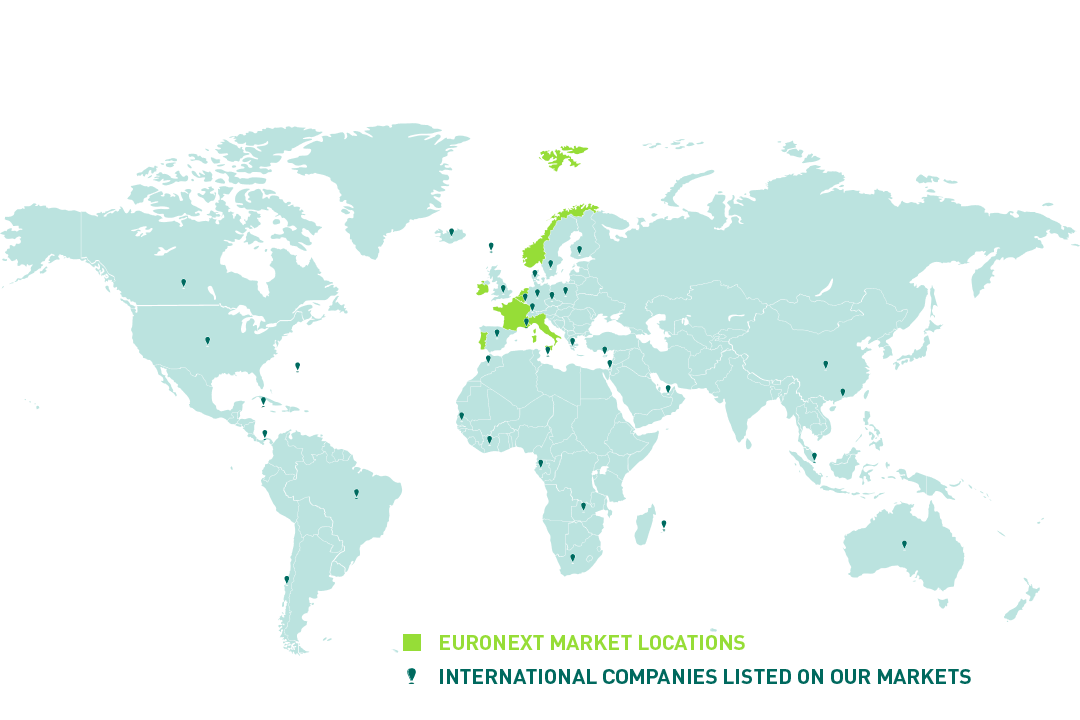

International listings

Our regional coverage

Euronext is already home to close to 200 international companies from all world regions.

Explore our regional coverage to get in touch with the right member of our team - based on the location of your business.

Simply click on "Discover our regions" to send a private message to the Euronext team.

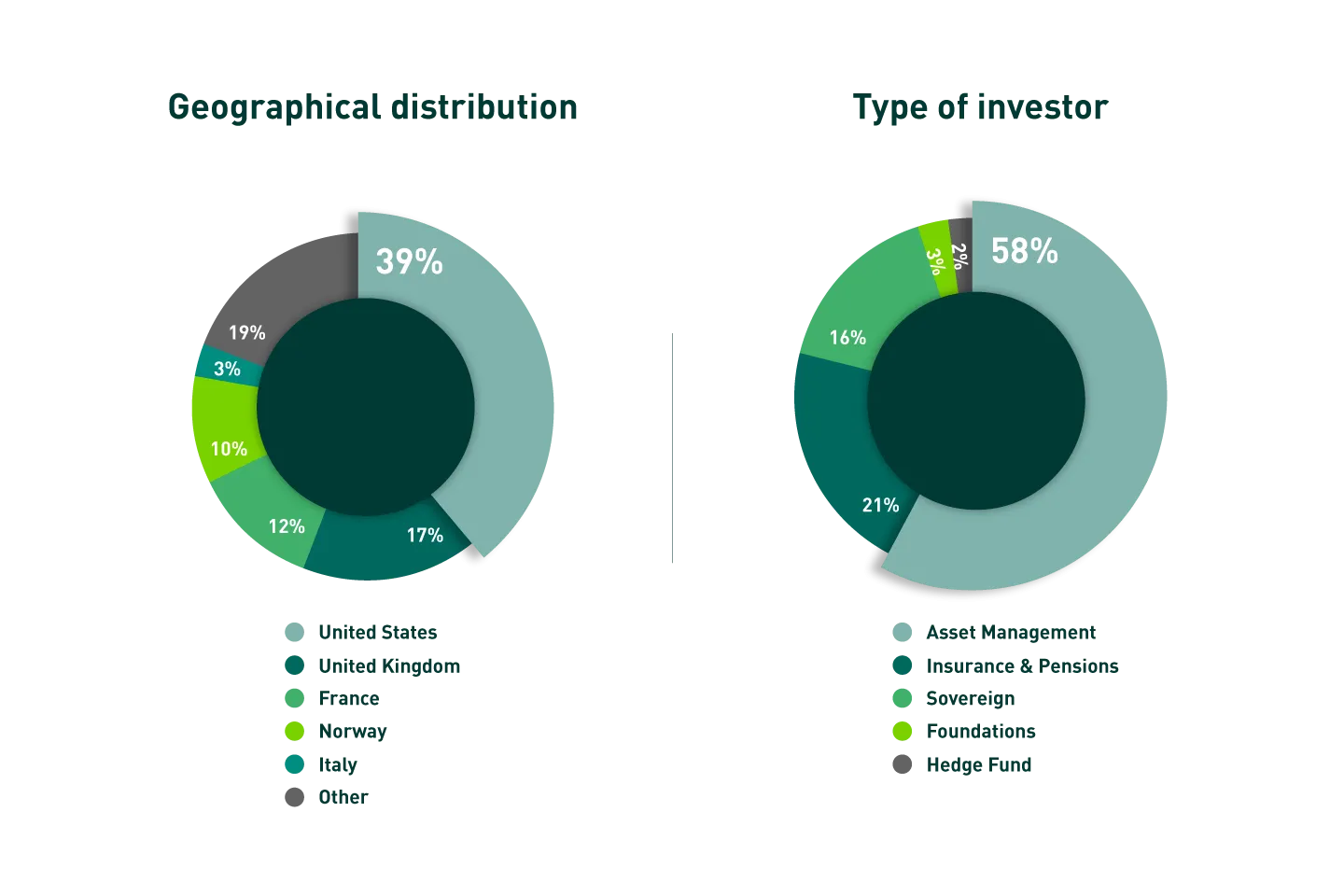

A large pool of investors

Access a large pool of 6,400+ institutional investors from 75 countries, especially from the United States (39%) and the United Kingdom (17%) - and benefit from greater liquidity and global visibility. We are at the heart of Europe’s financial landscape - our listing venues support any company looking to expand and grow its business globally.

Key benefits for companies to list on Euronext

Euronext international listing franchise

Region |

Euronext international listings |

Total Market Cap. (€bn) of international issuers |

International |

184 |

1,115 |

Europe |

129 |

604 |

Americas |

44 |

502 |

Asia - Pacific |

4 |

1 |

Middle East and Africa |

7 |

8 |

|

|

|

|

All issuers - Euronext |

1,888 |

6,544 |

Data updated as of 31 December 2023

‘International listings’ considered as companies having their HQ in countries where Euronext does not operate a listing venue.

Choosing the right market for your company

When listing on Euronext, companies must carefully consider which market would best suit their needs. They can choose their preferred market across Euronext locations: Belgium, France, Ireland, Italy, Norway, Portugal or The Netherlands.

The regulator can either be one of the selected market locations, or one of your company's countries of incorporation if registered in Europe.

Euronext offers both EU-regulated markets for large established companies and MTFs* for start-ups and SMEs.

We have a market to match all companies’ sizes and ambitions.

*Multilateral trading facility (MTF): financial trading venue dedicated to SMEs with lighter requirements

Already listed on another stock exchange?

Join the 42 international companies already dual-listed on Euronext and another stock exchange.

Euronext markets are open to dual listing for companies that wish to access European investors and raise their profiles. We offer simplified procedures which allow any listed company to dual list on Euronext markets.

For some countries, we also have agreements with local regulators which allow us to further accelerate the process.

To learn more, get in touch with our dedicated team.

Download the IPO Guide

Making your company publicly traded is an exciting opportunity opening up a world of possibilities. We've prepared a quick guide to help you understand the IPO process - requiring careful planning and preparation.

Get your copy of the IPO Guide and improve your knowledge of all the steps involved in going public.

Considering an IPO in the next 1-3 years?

With the support of 80+ partners and sponsors from the financial industry, Euronext has trained more than 900 companies since 2015.

Our educational pre-IPO programme, available in several countries in Europe, helps entrepreneurs get a better understanding of the capital markets.

Applications for our ongoing edition are now closed. Pre-apply and receive a notification for the next edition.

International companies listed on Euronext

Want to know more about our listing options?

As a global leader in a fast-moving industry, we need a partner that can connect us with the world markets, seamlessly, and efficiently.

- Sir Lucian Grainge

- Chairman and CEO

- UMG - Universal Music Group

- Listed on Euronext in 2021 - United States

With the listing, we have access to capital markets, and it is an important part of our growth plan. With additional funding, we are now able to accelerate growth. It also opens up opportunities to do acquisitions - to speed up the process of entering new markets.

- Remon Vos

- CEO

- CTP

- Listed on Euronext in 2021 - Czech Republic

We chose Euronext because it is a world-class exchange and very sizeable where we can grow for the future.

- Bob van Dijk

- Group CEO

- Prosus and Naspers

- Listed on Euronext in 2019 - South Africa

Our listing on Euronext reflects the growth and importance of our continental European operations and investor base.

- Soumen Das

- CFO

- Segro

- Listed on Euronext in 2020 - United Kingdom