All Bell ceremonies

-

8412a60b78c0-432d-4652-81bc-e38b2fb14737

Think Morningstar® North America Equity UCITS ETF

Think ETF’s launches new ETF

Think ETF’s has launched a new ETF on Euronext Amsterdam. Aaron Renkers, fund manager at Think ETF’s, sounds the gong.

The Think Morningstar® North America Equity UCITS ETF tracks the performance of the Morningstar® North America 100 Equal Weight Index™, a newly created index consisting of 100 of the largest and most liquid stocks listed in the United States and Canada. Think ETF’s will meet requests from clients to offer more regional building blocks. Along with the Think European Equity UCITS ETF launched last October, this latest offering is the second regional ETF being offered by Think ETF’s.

Think ETF’s is the first Dutch provider of Exchange Traded Funds (ETFs). The company was founded in 2008 and launched its first ETF in 2009. Morningstar Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia.

For more information: www.thinketfs.nl

Amsterdam

Amsterdam -

Theam

| Paris

8415aa085b0e-8972-4e4c-b18d-a28a04bd1c6aTheam

Denis Panel, CEO of Theam closes the European trading day in Paris

Closing bell ceremony to celebrate a major change in the methodology used for its Low Carbon 100 Europe Index®.

Theam and Euronext pursue commitment to SRI with new version of its Low Carbon 100 Europe Index®. This new method is based on a more efficient means of measuring the energy performance of businesses, and offers investors a unique index-based solution.

Paris

Paris -

SnowWorld

| Amsterdam

8411ae03ad7e-cc3f-4f98-af78-257210050761SnowWorld

SnowWorld marks two-year listing

By sounding the gong, SnowWorld (ticker symbol: SNOW) marks its two-year listing anniversary on the Amsterdam Exchange. CEO Koos Hendriks sounds the gong.

The reverse listing in December 2013 did not only improve SnowWorld’s solvency, but also provided them access to the capital markets. The company has thus become less dependent on the future availability of bank credit for the execution of its strategy.

The process of the IPO and subsequent issue of new shares in February 2014 led to a further professionalization of SnowWorld. The introduction of a Supervisory Board has played an important role and SnowWorld has formulated a clear strategy. The implementation of this strategy will take place within a framework of risk management and corporate governance.

For more information: www.snowworld.com

Amsterdam

Amsterdam -

ICMA Future Leaders

| Amsterdam

8410811d096f-f3d4-4981-8316-91e8a3c928d1ICMA Future Leaders

ICMA Future Leaders event visit Beursplein 5

Henk Rozendaal, Chairman of the International Capital Market Association (ICMA) Netherlands regional committee, sounds the gong to open trading on the occasion of ICMA’s Future Leaders’ event in Amsterdam.

ICMA has set up an ICMA Future Leaders Committee, for individuals in the early stages of their career, to improve its engagement with the younger generation among its membership. ICMA places great importance on reaching out to younger finance professionals in its member firms not only to raise awareness of the Association’s work and the benefits they could reap from its services, but also to foster a sense of community.

ICMA is the only trade association to grow up alongside the development of the cross-border capital markets. Not linked to any one national market, ICMA has promoted the development of efficient global capital markets for close to 50 years. Its code of industry-driven rules and recommendations is followed by its members and sets the recognised standard for best practice in the primary, secondary and repo markets for international fixed income and related instruments. ICMA has some 500 member firms in almost 60 countries, including banks and financial institutions who are active in international capital markets.

For more information: www.icmagroup.org

Amsterdam

Amsterdam -

Verenigde Nederlandse Compagnie

| Amsterdam

84091b685cd2-3562-4084-af39-b3c060222718Verenigde Nederlandse Compagnie

Verenigde Nederlandse Compagnie opens trading

Verenigde Nederlandse Compagnie (ticker symbol: VNC) opens trading at the Amsterdam exchange by sounding the gong.

Geert Schaaij, the CEO of Verenigde Nederlandse Compagnie, formerly Roto Smeets, has symbolically launched a new listed investment fund by sounding the gong.

The fund has three clear objectives; all acquisitions should have positive cash flow, a clear business model and have a growth potential which can create value per share. The objective is also directed to a solid dividend policy.

For more information: www.vncnv.nl

Amsterdam

Amsterdam -

Deceuninck bonds

| Brussels

841410d007bd-301b-488e-901d-db5625519108Deceuninck bonds

Deceuninck celebrates bond listing at Euronext Brussels

Baron PierreAlain de Smedt, Chairman of Deceuninck, opens the European stock markets with a Bell Ceremony at Euronext Brussels to celebrate the listing of the bonds issued Deceuninck for an amount of 100 million euros, with maturity of 7 years. The coupon amounts to 3.75% gross per year.

KBC acted as general coordinator in this transaction.

To know more about Deceuninck, please click on the following link : www.deceuninck.com

Brussels

Brussels -

Sustainable Stock Exchange

| Paris

84134ccb472e-a638-4148-9bb2-875925162ee4Sustainable Stock Exchange

COP 21: Euronext joins the U.N. Sustainable Stock Exchange Initiative

Amsterdam, Brussels, Lisbon, London and Paris – 7 December 2015 – Euronext, the primary exchange in the Euro zone, today announced that it has joined the United Nations' Sustainable Stock Exchanges (SSE) initiative. The UN SSE initiative aims to explore how exchanges can work together with investors, regulators, and companies to enhance corporate transparency on Environmental, Social and Corporate Governance (ESG) issues and encourage responsible long-term approaches to investment.

This morning Eric Usher, Acting Head of the United Nations Environment Programme Finance Initiative (UNEP-FI), rang the opening bell at Euronext Paris to mark the occasion. He was joined by the Chief Executives of other exchanges participating in the initiative and by the Chief Executive of ESMA.

Euronext’s five market operators[1] have voluntarily committed—through dialogue with investors, companies and regulators— to promote sustainable, long-term investment and improved ESG governance disclosure and performance among the companies listed on their exchange.

In line with this initiative, Euronext continues to launch products related to the financing of the real economy in support of sustainability projects. These include:

- Green Bonds: where funds raised are used exclusively to finance eligible Green projects such as renewable energy, sustainable land use, clean transportation, etc. In 2015, €3.84bn have already been raised through 11 green bond issues.

-

Sustainable indices: Euronext is working with Vigeo, the European leader in assessing companies’ and organisations’ extra-financial practices and performance, including environmental, social and governance (ESG) issues.

In addition, in November 2015, Euronext launched a new version of its Low Carbon 100 Europe Index®in partnership with Carbone 4 and CDP,introducing a more efficient means of measuring companies’ energy performance. - Commodities:Euronext has launched a number of products dedicated to financing the real economy, and our commodity contracts for milling wheat, rapeseed, corn and other products have long been relied upon as trusted global and European benchmarks. In June 2015, Euronext announced the launch of a Wood Pellet Contractleveraging favourable legislation in renewable energy to provide its clients with a product that supports renewable energy initiatives.

Stéphane Boujnah, CEO and Chairman of the Managing Board of Euronext NV, declared, “Joining the SSE initiative and partnering with the UN and our industry is another milestone in Euronext’s support for best practices in the environmental, social and governance fields, as well as for corporate social responsibility. As the leading pan-European exchange, operating regulated markets in five countries in Europe, Euronext has a responsibility to create a productive dialogue between investors and issuers, and encourage issuers to communicate their efforts in corporate sustainability. We look forward to participating in the Sustainable Stock Exchanges initiative as a global forum for sharing best practices on capital markets.”

Paris

Paris -

BE Semiconductor Industries

| Amsterdam

84082020c85c-725f-471a-8d13-5d4d2b19db7aBE Semiconductor Industries

BE Semiconductor Industries celebrates 20th listing anniversary

BE Semiconductor Industries (ticker symbol: BESI) celebrates its 20th anniversary as a public company by opening trading on Euronext Amsterdam with the sounding of the gong.

Richard Blickman, CEO of Besi commented: “We are pleased to be here today to commemorate our initial listing as a public company 20 years ago. Since our inception as a public company in 1995, it has been an exciting journey as Besi has grown from being a local Dutch system and tooling manufacturer to become one of the leading semiconductor assembly equipment manufacturers in the world.’’

Besi is a leading supplier of semiconductor assembly equipment for the global semiconductor and electronics industries offering high levels of accuracy, productivity and reliability at a low cost of ownership. The company develops leading edge assembly processes and equipment for lead frame, substrate and wafer level packaging applications in a wide range of end-user markets including electronics, mobile internet, computer, automotive, industrial, LED and solar energy. Customers are primarily leading semiconductor manufacturers, assembly subcontractors and electronics and industrial companies.

For more information: www.besi.com

Amsterdam

Amsterdam -

8407db1fa58b-e1c3-469b-904c-e54d693febda

Real estate certificate ‘Immo Mechelen City Center’

Kim Creten, CEO of KBC Real Estate rings the bell to celebrate the first listing of the real estate certificate ‘Immo Mechelen City Center’ on Euronext Brussels. This is the first real estate certificate for private investors since 10 years.

Brussels

Brussels -

Business Walk of Fame

| Amsterdam

8403a5b8ffae-0384-4f4e-ada8-0aa988508a25Business Walk of Fame

Nominees Business Walk of Fame visit Beursplein 5

The Business Walk of Fame praises companies that are committed to an inclusive labour market. On World Disability Day, 3 December, the Lucille Werner Foundation announces the winners of the Business Walk of Fame 2015. Lucille Werner, in presence of the nominees, calls attention to the importance of an inclusive labour market by sounding the gong.

The Business Walk of Fame is a promenade of tiles on the Claude Debussylaan at Zuidas Amsterdam. Lucille Werner: ‘’In a time where companies are forced to think about this subject in regards to the law of participation, we want to show a positive stimulating project to reward the companies that have taken their first steps.’’ The jury has selected the nominees and winners from the applications. The jury consists of several representatives from the industry, government and interests groups, as well as last year’s winners.

For more information: www.lucillewernerfoundation.nl

Amsterdam

Amsterdam -

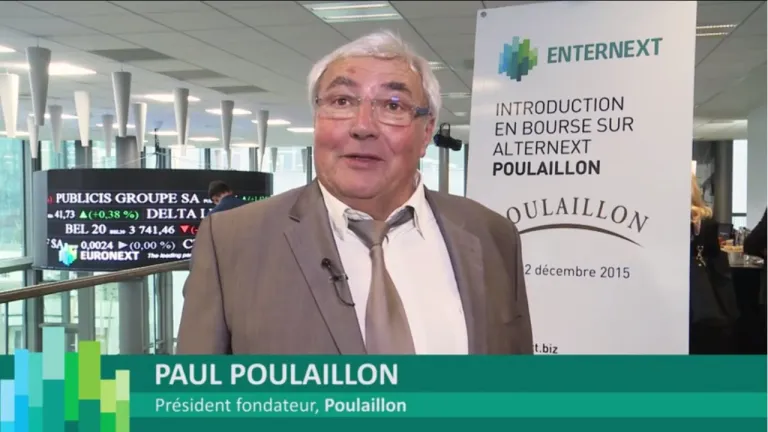

Poulaillon

| Paris

8406122bd838-3cb7-4bbd-a295-a221c4b36ec7Poulaillon

Listing on Alternext of Poulaillon

Poullailon opens the European trading day in Paris.

Poulaillon specializes in the manufacture and marketing of fresh and deep frozen bakery and pastry goods (breads, Viennese pastries, sandwiches, moricettes, mignardises, entremets, cakes, etc.). Besides, the company develops a catering activity.

At the end of 2014, products are distributed through a network of 35 stores located in France, and via hypermarkets, local retailers, the out-of-home dining, vending machines, etc. Paris

Paris -

Shell LiveWIRE Award 2015

| Amsterdam

84023537c6eb-8aad-406d-8e7f-bcca2cfdf2afShell LiveWIRE Award 2015

Finalists Shell LiveWIRE Award 2015 sound gong

Shell LiveWIRE Award 2015 finalists, Alexander Gunkel of Skytree, Marcel Fleuren of ECO-L, and Maja Rudinac of Robot Care Systems open the trading day, Alexander Gunkel sounds the gong.

Shell LiveWIRE is an international programme initiated by Shell (ticker symbol: RDSA) that aims to help young, innovative entrepreneurs develop their business. Each year over 800 entrepreneurs receive free professional coaching and training through personal coaching, master classes as well as access to an expert network.

The Chamber of Commerce implements Shell LiveWIRE program in the Netherlands. The programme is active in 15 countries.

For more information: www.livewire.nl

Amsterdam

Amsterdam -

De Salon of Royal Concertgebouw Orchestra

| Amsterdam

840190152f01-fd3b-4122-8870-7cd9e26b3fa9De Salon of Royal Concertgebouw Orchestra

De Salon of Royal Concertgebouw Orchestra opens trading

The trading day is opened by members and partners of De Salon; the business circle of the Royal Concertgebouw Orchestra, musicians, and board members of the Foundation Donors Royal Concertgebouw Orchestra.

Four young orchestral musicians - violinists Sylvia Huang and Mirelys Morgan Verdecia, violist Martina Forni and cellist Honorine Schaeffer - form GoYa Quartet. On 27 October, the Prix de Salon was awarded to them at the office of Euronext. Prior to the sounding of the gong they will give a musical performance.

The Prix de Salon is given annually by the business circle of the Royal Concertgebouw Orchestra awarded to musicians of the orchestra. GoYa quartet wants to organize a series of three concerts with music by Brahms and Schumann, where the audience is involved with the music in a special way.

For more information: www.concertgebouworkest.nl

Amsterdam

Amsterdam -

Credion

| Amsterdam

84000f34d79d-806a-417a-95a8-8746e685e178Credion

Credion and EnterNext offer financing solutions to SMEs

The collaboration between Credion and EnterNext commences by sounding the gong at Beursplein 5. With a positive view on entrepreneurship and a large and valuable network, Credion and EnterNext will contribute to financing solutions for small and medium-size enterprises (SMEs).

Carlo van der Weg, director Credion Association, sees this cooperation as an important opportunity for SMEs: "Lending is an important issue for SMEs. Entrepreneurs should have the opportunity to choose from a diverse range of funding options. Together with EnterNext, we offer SMEs several excellent alternatives. "

EnterNext is a subsidiary of Euronext, and focuses on listed and unlisted small and medium sized companies with a market capitalization of less than €1 billion. EnterNext is specially created to assist and encourage small- and medium sized companies in their growth.

Credion is a national consultancy established in 2001 with over 45 offices spread across the country. Credion specializes in raising debt financing for SMEs. Due to its rural position and its many guided transactions, Credion is able to provide more channels for funding.

For more information: www.credion.nl

Amsterdam

Amsterdam -

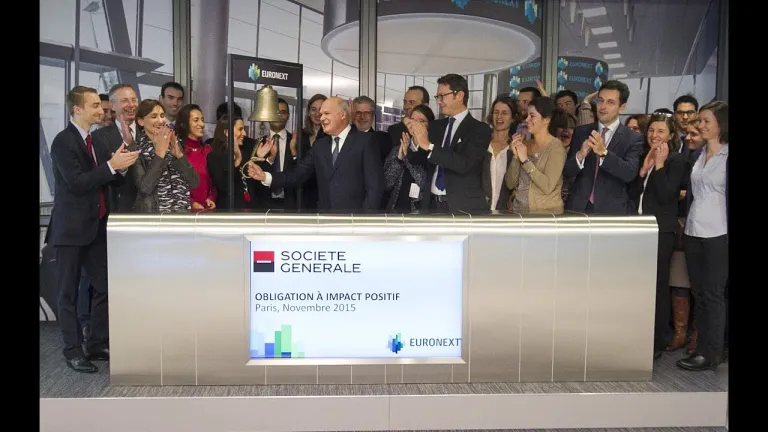

84050597c6b4-d7aa-4878-b6cd-585b6436de3a

Societe Generale successfully issued first Positive Impact bond

Séverin Cabannes, Deputy Chief Executive Officer, Société Générale group opens the European trading day in Paris.

Societe Generale successfully issued the first Positive Impact bond on November 18th. The funds raised by this bond, which is underpinned by a very innovative methodology, and complies with the highest environmental and social standards as well as with the highest requirements for traceability and transparency, are used to finance or refinance projects which contribute to the fight against climate change. The Positive Impact bond demonstrates Societe Generale’s ability to develop innovative financial solutions for its clients, facilitating the transition towards a low carbon economy.

Paris

Paris -

Partnership Commerzbank and Turbotrends

| Amsterdam

8397ab2b488f-c942-41a9-8bed-4a8167035715Partnership Commerzbank and Turbotrends

Commerzbank and Turbotrends celebrate partnership by sounding gong

Commerzbank celebrates its partnership with Turbotrends by sounding the gong at the Amsterdam exchange.

As an issuer of Warrants and certificates, Commerzbank offers a comprehensive range of financial instruments in Europe. With an offer of more than 160.000 products and many years of experience, Commerzbank is one of the largest and most prominent issuers of structured financial products in Europe. Turbotrends is an independent financial information company that has been active since 1996.

Together with this new partner, Commerzbank organizes various activities, such as webinars, seminars and a weekly Turbo chat. The goal of the collaboration is to better inform retail customers about the functioning of the product offered by the Commerzbank, and inspire customers to use them. Turbotrends will provide analyses, news updates and practical tips. Christophe Cox of Commerzbank sounds the gong.

For more information: www.beurs.commerzbank.comDownload photo

Amsterdam

Amsterdam -

TDF

| Paris

83997efddf53-3990-4516-9d0b-97f6ec92aa83TDF

Olivier Huart, CEO of TDF, opens trading at Euronext

Olivier Huart, CEO of TDF, opens trading on Euronext's European market to celebrate a first Bond issuance by TDF Infrastructure

Paris

Paris -

SME Idea Election

| Amsterdam

8396fa4a5cc3-27a0-4b36-a109-52c3ce2183e5SME Idea Election

Winner SME Idea Election celebrates victory

The winner of the SME IDEA Election, Keyplan, opens trading at the Amsterdam exchange.

The gong ceremony marks the conclusion of the SME IDEA Election, and is attended by the winner and a representation of the founders MKB-Nederland and KPN (ticker symbol: KPN). Keyplan is a real-time solution which manages the whole facility section of a holiday park; from housekeeping to technical services.

The SME IDEA Election is all about ‘growth by ICT’. Which innovations help an entrepreneur to realize the best growth? MKB-Nederland and KPN searched together for entrepreneurs that by implementing new technologies achieved growth for their business. MKB-Nederland and KPN organized the SME IDEA Election for the second time.

For more information: www.mkbideeverkiezing.nl

Amsterdam

Amsterdam