All Bell ceremonies

-

7713c102b908-b9ee-402b-8901-67cbbaefe782

SOS Children’s Villages visits Euronext Amsterdam

SOS Children’s Villages has been committed to children without parents or safe home for 65 years.

The international children's charity believes that family is the most important basis for the healthy development of children. Thanks to SOS Children’s Villages hundreds of thousands of children worldwide have found a solid foundation to develop into independent and promising adults. Preferably within the family, but if that's not possible, in a SOS family in a Children's Village.

Ceu Gonçalves grew up in Portugal with her two sisters in a SOS Children's Village because they would have otherwise stood alone. Ceu looks back on a loving and secure childhood with her mother and her SOS brothers and sisters. She went to school, graduated, got a job and met her (Dutch) husband. They now live with their daughter in the Netherlands. Ceu is an example of how children can grow up happily with family love and how they can develop. Ceu Gonçalves sounds the gong to call attention to all children in the world who stand alone.

For more information: www.soskinderdorpen.nl

Amsterdam -

771426e82972-c85e-4141-9266-0d054f659075

Man and robot celebrate 100-years Shell innovations by sounding gong

On 24 February 2014 it will be precisely 100 years since Shell (ticker symbol: RDSA) began its research activities in Amsterdam Noord. With the help of a robot from the University of Twente, Shell’s Chief Technology Officer Gerald Schotman sounds the gong to kick off this jubilee year, and to highlight the cooperative efforts of universities, government and companies aimed at accelerating the rate of innovation in the Netherlands.

The robot arm, specially programmed for this occasion by staff from the University of Twente, symbolizes cooperation between participants in the European Petrobot project. Together with other parties, including scientific advisors from the University of Twente and the University of Zurich (ETH), Shell is working within the framework of the EU to develop robots that can inspect petrochemical tanks. What began as a modest laboratory in Amsterdam, has since become a leading institute, and one of Shell’s three most important global technology centres.

For more information: www.shell.com

Amsterdam -

Hulplijn Amsterdam visits Euronext Amsterdam

| Amsterdam

7715838f431f-c80a-4e1e-8690-2d7f95146e5eHulplijn Amsterdam visits Euronext Amsterdam

Hulplijn Amsterdam (previously known as Sensoor Amsterdam) has already been active for over 50 years and sounds the gong for its new identity.

Hulplijn Amsterdam is a 24 hours chat- and phone helpline for everyone in need of an anonymous conversation. Hulplijn Amsterdam is a professional organisation with on average 80 well-trained volunteers and a small permanent team of paid staff. Hulplijn Amsterdam provides a service in which the volunteer offers real attention and contact to the person calling. All together the volunteers have more than 20.000 conversations per year. The reasons for people to contact are varied and topics range from depression and psychological problems to loss of work and health. Loneliness plays a big part in many of these cases. CEO Ed Theunen sounds the gong.

For more information: www.hulplijnamsterdam.nl

Amsterdam -

Gong marks listing Novisource

| Amsterdam

77167c1c35b8-f4b8-4fad-a93e-6bbfe9ea2e22Gong marks listing Novisource

CEO of Novisource, Willem van der Vorm, sounds the gong to mark the listing of Novisource (ticker symbol: NOVI).

The new listing gives Novisource access to the capital market, enabling it to give further shape to its growth strategy. Novisource’s portfolio of brands includes Novisource Banking & Investments, Novisource Insurance & Pensions, Novisource Technology Services, B-Street and quality rating company Inhuurwijzer. Every day, Novisource’s project managers, business consultants and interim managers translate current and relevant business and ICT themes into the operations and operational processes of organisations, predominantly in the financial sector. They bring to the table a purely enterprising approach and the ability to deliver. Novisource helps organisations to develop and to achieve their goals. Novisource’s Technology Services brand chiefly targets the Telecom, Technology and Utilities industries. Under the B-Street label, the company supplies and deploys interim professionals who are hired externally. B-Street allows the company to respond quickly to clients’ requests without being exposed to any risk of overcapacity. B-Street possesses an extensive network of external interim professionals.

For more information: www.novisource.nl

Amsterdam -

771914ff4ef5-a073-488c-8e9f-ba9e4e7f4c79

EnterNext welcomes Crossject on Alternext Paris

Patrick Alexandre, Chairman and Chief Executive Officer of Crossject rings the closing bell.

Crossject specializes in manufacturing and marketing needleless drug self-injection. The group provides Zeneo, a prefilled and single-use device that can be used for intradermal, subcutaneous and intramuscular injections.

Paris -

Kids Moving the World and PostNL sound the gong

| Amsterdam

76796d85a3db-8051-4e84-84b8-d51b9cc9ca9bKids Moving the World and PostNL sound the gong

The Kids Moving the World Foundation, and PostNL, sound the gong in honour of the 444,000th child to take part in one of the programmes organised by Kids Moving the World.

Kids Moving the World works to raise awareness among children in the Netherlands of some of the issues the world faces. Various education modules are used to introduce children to issues such as hunger, poverty and sustainability. For over 10 years PostNL, together with Ricoh and PWC, have supported the lesson plans that the organisation develops for primary school children. Their employees act as Game Guides, providing the final lessons for primary school classes from years 1 to 8. Game Guides play a colourful, interactive game with the children, which corresponds to learning material that teachers have presented to them in advance. Currently, over 250 volunteers are active as Game Guides, providing 1700 lessons at 550 schools throughout the Netherlands. Game Guide Vesna de Buck from PostNL sounds the gong along with three pupils from the De Rosa School in Amsterdam.

For more information: www.kidsmovingtheworld.nl

Amsterdam -

7678bd6f4620-2862-4719-bc53-b359affe04a2

Tradzster sounds gong for launch of trading platform

On the 18th of February Tradzster launches the first, full release of its innovative trading platform. CEO, Robbert Boutkan, sounds the gong.

The new broker/trading platform Tradzster will focus on innovation and useful functionality benefiting the online investor. Tradzster is a trading name of Capital Intervest BV and is active as a Dutch broker since the end of 2013 with a user friendly, in-house developed trading platform which enables the online investor to manually or automatically trade the global financial markets. Tradzster stands for innovative online trading for both the retail and professional online investor.

For more information: www.tradzster.com

Amsterdam -

7677f1339599-62a5-4ab7-97b7-1e408b42fe8f

Marianne Vos sounds the gong to celebrate being named Sportswoman of the Year

Marianne Vos, a cyclist from Brabant who has been named Sportswoman of the year for the third time, sounds the gong.

Vos has won twelve world titles in three different cycling events: cyclo-cross, road and track. At the beginning of February she won the World Cyclo-Cross Championship, which was held in Hoogerheide, for the seventh time. She also holds two Olympic titles. During the 2008 Beijing Olympics she captured the title for the points race in field cycling. Four years later, in London, Marianne’s career reached a high point when she won the most coveted gold medal in cycling: the road race title. The winner of so many awards is certainly one of the most successful sportspersons in the Netherlands.

Marianne Vos is also active when she is not cycling. As a member of the Athletes Committee of the UCI (the international cycling union) she represents the women’s team, with a special focus on the future of women’s cycling. In addition, Marianne Vos is an ambassador for BikePure and 100% Dope Free, anti-doping organisations that want to ensure that the sport is completely clean.

Amsterdam -

7676b31fd753-054b-47cc-9ab3-b3dcbc60fc88

Only Friends & Johan Cruijff Foundation celebrate anniversary

Sport club Only Friends sounds the gong to celebrate its 14th anniversary.

Founder Dennis Gebbink started Only Friends 14 years ago and celebrates this together with the Johan Cruijff Foundation, a foundation with which Only Friends has a close relationship for many years now.

Only Friends is an organization that provides sports and activities for disabled children and young adults. With the help of 150 volunteers and 50 interns the organization is able to offer the 600 members a variety of 19 sports and activities, 7 days a week. Chairman of Only Friends, Jacques Parson, and president of the Johan Cruijff Foundation, Carole Thate, sound the gong.

For more information: www.onlyfriends.nl

Amsterdam -

7675604e7f60-c3b4-4956-84ac-466cf188aa2c

Royal Delft Group celebrates 60th listing anniversary

CEO of the Royal Delft Group, Henk Schouten, opens trading to celebrate 60 years of listing at Euronext Amsterdam.

For Delft earthenware manufacturer “De Porcelyne Fles”, established in 1653, 2014 is a special anniversary year in a couple of ways. 110 Years ago, in February 2014, the company turned the legal entity form into a Public Limited Company (PLC). Besides this it is 60 years ago that the company applied for stock exchange listing on Euronext Amsterdam.

Since 2008 the Royal Delft Group does not only consist of Royal Delft, well-known for the Delft Blue earthenware, but also Royal Leerdam Crystal, silver manufacturer Koninklijke Van Kempen & Begeer and BK Cookware. From that moment forward the group has also been active on the markets for pans, cutlery and designer products.

For more information: www.royaldelftgroup.com

Amsterdam -

ALS Foundation sounds gong for Valentine’s Run

| Amsterdam

767444956b2e-3d12-49ae-95fb-3c544fe1f2bdALS Foundation sounds gong for Valentine’s Run

On Friday February 14, Valentine's Day 2014, the first edition of Valentine’s Run is organized in the Vondelpark in Amsterdam.

In America, the Valentine's Run is hugely popular and millions of dollars have been raised for charity so far. The Valentine’s Run is an official five-mile track, but before and after the run several romantic activities are organized to celebrate love. On top of that, money will be raised for the ALS Foundation. The registration limit for single women has been achieved, but for about 50 single men, there is still a chance to sign up for the most loving run of the Netherlands. ALS Foundation sounds the gong together with the event organizer Tim van Os and Madventures CEO, Maarten Hendriks.

For more information: www.valentijnsloop.nl and www.stichting-als.nl

Amsterdam -

iShares sounds gong for ETF launch

| Amsterdam

7673c0fcd3af-bd55-464e-aeb3-fd70f527f9b5iShares sounds gong for ETF launch

iShares, the exchange-traded funds offering of BlackRock (ticker symbol: BLK), listed its iShares Euro Stoxx 50 ex-Financials UCITS ETF (EXFN) on the Amsterdam market of Euronext. This fund is the first ETF to come to market in continental Europe using an international security structure, where settlement of transactions is exclusively at Euroclear Bank – the Brussels-based international central securities depository (ICSD).Head of iShares The Netherlands, Gert-Jan Verhagen, sounds the gong.

The newly listed iShares EURO STOXX 50 ex-Financials UCITS ETF is a physically replicating fund which invests in blue chip stocks from 12 eurozone countries, while excluding companies from the financial sector, potentially providing investors with a less volatile exposure to Eurozone equities. The fund has a total expense ratio of 20 basis points.

The newly listed ETF follows a successful year of new listings on Euronext’s ETF market in 2013. Euronext reported growth in new ETF listings of 76% versus 2012, with a total of 51 listings on its European market totalling 564 ETFs. In Amsterdam, the growth in new ETFs was up by 223% compared to 2012, totalling 127 ETFs.

For more information: www.blackrock.nl

Amsterdam -

766366814b0c-2b1f-437f-b993-afca95643978

ACTIVITY IN EUROPE

Total amount of capital raised on Euronext’s markets in 2013

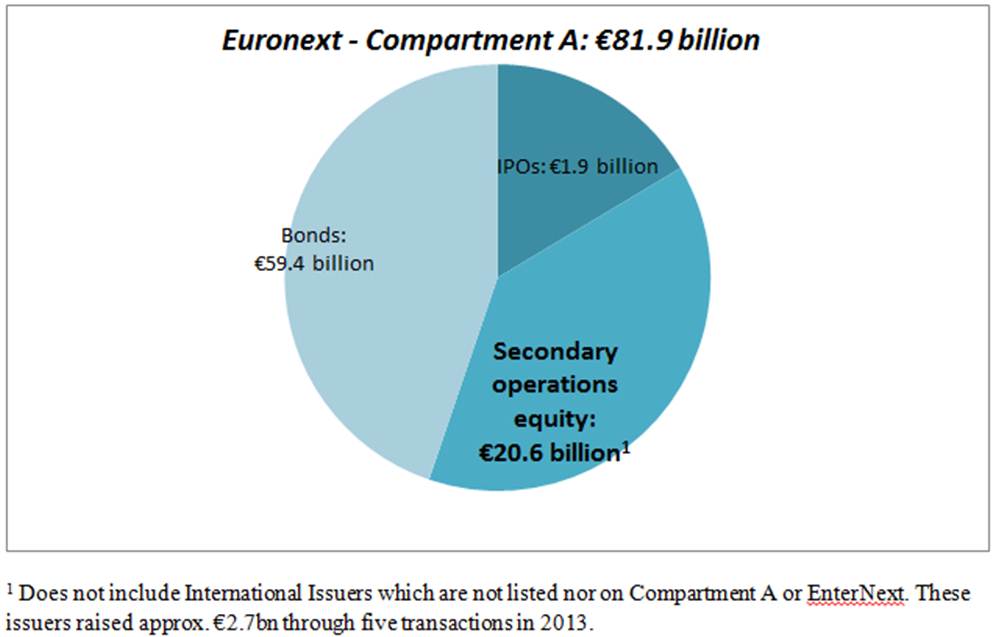

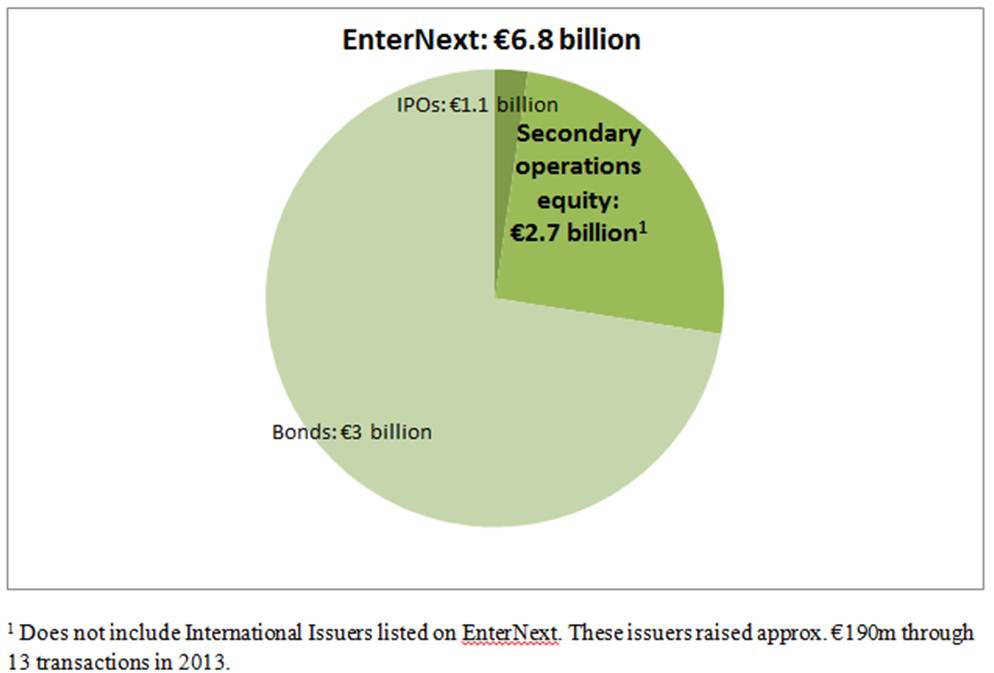

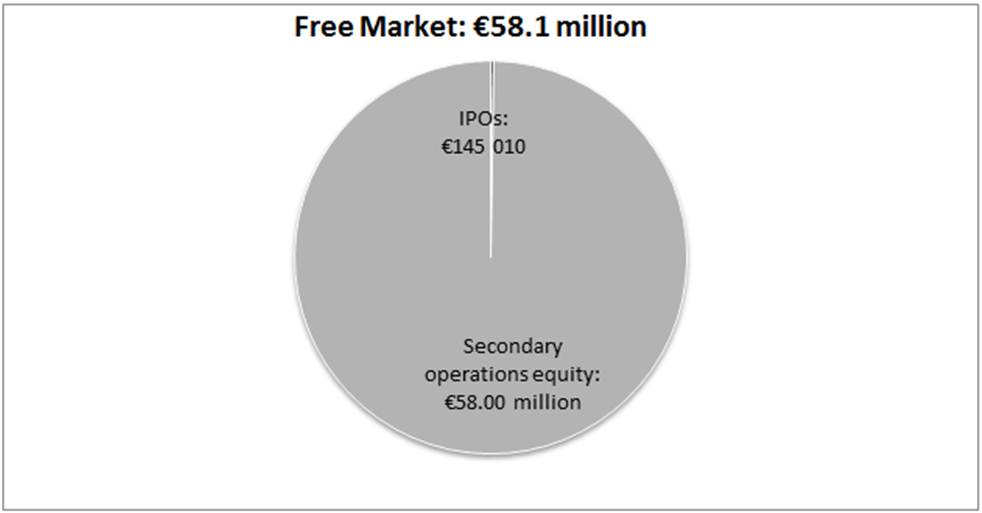

Companies listed on Euronext and EnterNext raised €92 billion in 2013, including €81.9 billion on Euronext – Compartment A and €6.8 billion on EnterNext, the new pan-European marketplace dedicated to SMEs1.

Five most important capital raises on Euronext – Compartment A in 2013

Date

Issuer

Operation

Amount Raised (€million)

17 May

KPN KON

Cash issue following a public offer

4 766

3 Jun

ASML Holding

Private Placement

2 296

14 Jan

ArcellorMittal

Private Placement

1 340

9 Dec

Alcatel-Lucent

Cash issue following a public offer

956

23 Dec

Royal Dutch Shell

Stock Dividend

949

Five most important capital raises on EnterNext in 2013

Date

Company

Operation

Amount Raised (€million)

5 Dec

CTT Correios Portugal

IPO with capital raised

579

24 Apr

Belvédère

Issue reserved to dedicated person

347

25 Nov

Nieuwe Steen

Private Placement

345

17 Dec

Caixa Economica Montepio Geral

IPO with capital raised

200

28 May

Vivalis

AP with capital raised

134

-

766290b6f99b-8328-4f4e-a0e0-1d764dfd8c25

London Newsbites

Norbert Dentressangle bets on a dual listing in London and Paris

Norbert Dentressangle, a major European transport, logistics and freight forwarding company, entered Euronext’s London market on 4 July 2013. This is a dual listing for Norbert Dentressangle which is already listed on the Exchange’s Paris market. To celebrate Norbert Dentressangle’s first day of trading on Euronext London, Chief Executive Officer, Hervé Montjotin, rang Euronext’s European market Opening Bell at the Exchange’s London office.

Hervé Montjotin CEO of Norbert Dentressangle said: “This event represents an important step in the growth of our company. It will help to diversify and expand our shareholder base by giving us access to Euronext’s extensive network of London-based institutional investors, and will position Norbert Dentressangle as a leading international, transport, logistics and freight forwarding company. We also believe our listing on Euronext London will raise the profile of Norbert Dentressangle amongst the UK investment community who have a wealth of experience in the transport, logistics and supply chain sector, and a good understanding of the key business attributes required to succeed in this highly competitive and increasingly global marketplace.”

Contacts

Albert Ganyushin (Director International Listings, Euronext)

Tel. +44 20 7379 2560

AGanyushin@euronext.comThomas Le Doeuff (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 13 92

tledoeuff@euronext.comFrédéric Martineau (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 13 11

fmartineau@euronext.comNathanael Mauclair (Business Development Manager International Listings, Euronext)

Tel. +33 (0)1 49 27 11 56

nmauclair@euronext.comExpertLine: +44 20 73 77 35 55

For more information or for specific questions, please contact your Account Manager or send an email to MyQuestion@euronext.com.

-

7661080fa9bc-a531-4902-84b5-8223294951ee

Save the date! The Pan-European IR conference, 23 and 24 September, in Brussels

The next Pan-European IR conference will be held in Brussels on 23 and 24 September and will bring together delegates from the IR associations of the Netherlands (NEVIR), France (CLIFF), Belgium (BIRA) and Portugal (FIR), as well as from Germany, Switzerland and other European countries.

The 2014 conference, organised by these four associations, as well as Euronext and Tradinfo, will be the largest event ever for the European IR community helping you to extend your knowledge of current topics and leading IR practices. In addition, there will be ample opportunities to exchange and share experiences with peers and industry experts and to enhance your career through collaborative learning, leading edge content, and unparalleled networking opportunities.

The success of the Pan-European IR conference is due to the program being set up by IROs for IROs. The theme of the conference and the topics for each of the sessions will therefore be proposed by the IR associations themselves.

The conference will kick off with an exclusive dinner event in the Palais de la Bourse, which will include an entertaining keynote address delivered by a well establised speaker. In addition, during the evening we will celebrate together with Thomson Reuters Extel the annoucement of the winners of the 2014 IR awards for Belgium, France and Portugal.

The following day we will start with the Opening Bell Ceremony by the IR Presidents, followed by three extensive and interactive parallel sessions, with a focus on sharing experiences through ‘best practice’ or ‘case study’ presentations. The networking lunch will be organised as an introduction to the sector approach in the afternoon sessions. Each of the standing tables will indicate a sector, so that the IROs have the opportunity to meet their counterparts in an informal setting.

In the afternoon, there will be around six parallel sector breakout sessions, specifically designed around the topical issues in specific industries. This set-up guarantees a customized approach tailored to the interest of the IROs. In addition, there will be also a parallel generic breakout session, in case an IRO does not want to join one the sector sessions. The event will end with drinks.

The website ‘Pan-European IR Conference’ will be updated in a few weeks. Registration will start in March at https://www.european-ir-conference.com.

We look forward to welcoming you!

-

7660db6d3b2e-9d25-44d3-a421-4ae28aeb98ba

The stock exchange requires greater discipline, in terms of transparency and strategy definition

Portuguese postal group CTT successfully entered Euronext Lisbon on 5 December 2013. The CEO of CTT, Francisco Lacerda, discusses the operation and explains the benefits of listing.

What was CTT’s goal in listing on the stock exchange?

The main reason was for the Portuguese state to fulfil the conditions of the privatisation programme set out in the financial aid plan negotiated with the European Union and the International Monetary Fund in May 2011. Previously wholly owned by the state, CTT was among the list of assets that Portugal had agreed to sell. We also needed to acquire a shareholder base that would be capable of supporting the group’s future.

Are you satisfied with investor response and the results of the operation?CTT’s introduction on the market on 5 December 2013 was undeniably a success. The introductory price of €5.52 per share was set in the upper range of the price spread considered, so the Portuguese government, which sold 70% of the capital of CTT, took in nearly €580 million – a good sign of investor enthusiasm. Institutional investors acquired 80% of the shares sold on the market, and thus hold 56% of our capital. The remaining 14% of capital was reserved for individual investors, including the group’s employees who benefited from preferential pricing at €5.24. The security has remained strong since the first day of listing and currently sells above its introductory price.

Is your presence on the stock exchange likely to influence your strategy?Our dialogue with investors will probably have an influence on the group’s strategy. However, this is not a current concern. Our strategy was redefined before entering the market, and it is on this basis that we presented ourselves to investors. It would not be reasonable to revise it today. We will thus continue our efforts to generate cash flow via a multi-product strategy (mail, financial services) and a generous dividend distribution policy. We are committed to pay €60 million in dividends in 2014, or a distribution rate of our net profits of at least 90%.

What benefits do you think you will gain from this listing, and what advice would you give another company planning to enter the stock exchange?Listing on the stock exchange gives us broader access to capital, which is clearly an advantage for the group’s development. It also has a more subtle, and I think positive impact, by requiring increased discipline, in particular in terms of transparency but also in strategy definition and implementation. And this is the advice I would offer a candidate for listing: develop a clear, coherent and realistic strategy that can be used to present extremely structured messages to investors. The experience has been a very positive one for us.

-

765965d505f5-237e-4737-a905-e5c6c0166e66

European Smallcap Event in Paris on 7 and 8 April 2014

Euronext will host the next European Smallcap Event organized by CF&B Communication on 7 and 8 April 2014 at the Pullman Tour Eiffel Hotel. Every year, this Euronext-sponsored event brings together some fifty companies listed on Euronext’s French, Belgian, Dutch and Portuguese markets, along with institutional investors, fund managers and financial analysts. The listed companies take part in workshops and seminars run by experts from throughout the euro zone, and enter into one-to-one discussions with the participating investors.

Register at: info@midcapevents.com

-

766546c3a6f4-e575-4901-944a-68f97edcc43e

Eric Forest: “The stock market is neither too complex nor too demanding for SMEs”

In May 2013, NYSE Euronext announced the launch of EnterNext, the new pan-European marketplace dedicated to SMEs.

In May 2013, NYSE Euronext announced the launch of EnterNext, the new pan-European marketplace dedicated to SMEs.

CEO Eric Forest takes a look at the specific needs of this category of companies and at EnterNext’s goals.What is the role of EnterNext?

EnterNext was created with the purpose of helping small and medium-sized companies (SMEs) find alternative sources of financing. Our role is to assist companies listed on compartments B and C of Euronext or on Alternext – companies with a market valuation of less than one billion euros – to make better use of the market, as well as to help unlisted companies prepare for possible entry on the stock exchange. It is also crucial to promote these companies among investors, and more generally to activate the entire ecosystem in seeking solutions to the challenges of financing their growth.What are the specific needs of SMEs with regard to the stock exchange?

SMEs today need alternatives to bank loan financing. Loans have become harder to obtain with the recession and new bank equity regulations which allows the stock market to reassert its role. The market environment is also more favourable today. The launch of the SME stock savings account (the French Plan d’épargne en actions dedicated to SMEs), for example, will “fuel” our market by drawing more savings to investment in small and medium-sized companies, enabling these to strengthen their equity.What are your goals?

We target the listing of 80 new companies per year in the four Euronext markets (Paris, Brussels, Amsterdam and Lisbon) by 2016. In 2013 there were 26 new entries in the market. This reflects an upward trend from the 16 new listings in 2012. It is important to point out the acceleration of this trend, with half of these operations completed in the final quarter of the year. Our second goal is to significantly increase the volume of funds raised in equity and bonds for the companies that form our target group. And most broadly, we aim to position the stock market as a source of financing for SMEs.What obstacles do you anticipate?

We must fight preconceptions and recall to mind a few truths by explaining things clearly and educating company executives. No, turning to the stock exchange is neither too complex nor too demanding. You have to learn to use it. No, smaller securities are not at a disadvantage in terms of performance, on the contrary! While the French CAC 40 index has risen 24% in ten years, the CAC Mid & Small index has registered growth of 130%. And no, issues of liquidity of smaller stocks should not be seen as inevitable. Liquidity must be understood as the ability for an investor to enter or exit the market at the desired moment. Company executives therefore have a role to play: the company must interest and be interested in the market over the long term, which is achieved through active marketing of its security.

Mentalities are changing, and one very encouraging point of note is the return of institutional and individual investors to small and medium-sized stocks. This is apparent in the success of the latest operations on our markets, which generated a level of demand such as we have not seen for several years.