List your ESG Bonds on our Euronext markets

The first green exchange

Euronext has been a partner in the UN Sustainable Stock Exchanges initiative (SSE) since 2015. Today, Euronext enables issuers to list the full range of labelled ESG bonds including use-of-proceeds and general purpose bonds in all internationally recognised currencies.

From green and social bonds to sustainability and sustainability-linked bonds, Euronext is trusted by sovereigns, corporates, financial institutions and many other issuers.

Why list your ESG bonds on Euronext?

Simplified process

Our expert team guarantees quick review times

Competitive fees

The listing fees are transparent and cost- effective.

Market facing

Open communication and dedicated experts.

Higher visibility

List your securities to attract investors.

Explore the listing process

Select one of our markets to learn more about issuing debt securities on Euronext.

MTF (Multilateral Trading Facility)

Self-Regulated Market

Types of ESG bonds

Your ESG bonds should meet recognised standards, such as the ICMA Principles, and must have obtained an external verification. If you want to list ESG bonds on Euronext, we expect you to publish post-issuance impact and allocation reports on your website, although this is not obligatory.

How to list ESG bonds on Euronext

- Complete a listing on any Euronext bond market

- Make your ESG bond documentation available on your website (including a third-party external review)

Euronext ESG Barometer

With the aim of shedding some light on the latest trends in the ESG market, our team analysed the market developments to date, important regulatory aspects and hot ESG topics.

This edition contains two long exclusive interviews with sustainable leaders from ING and Scope Group, who share their views on the market and explain their sustainable strategy.

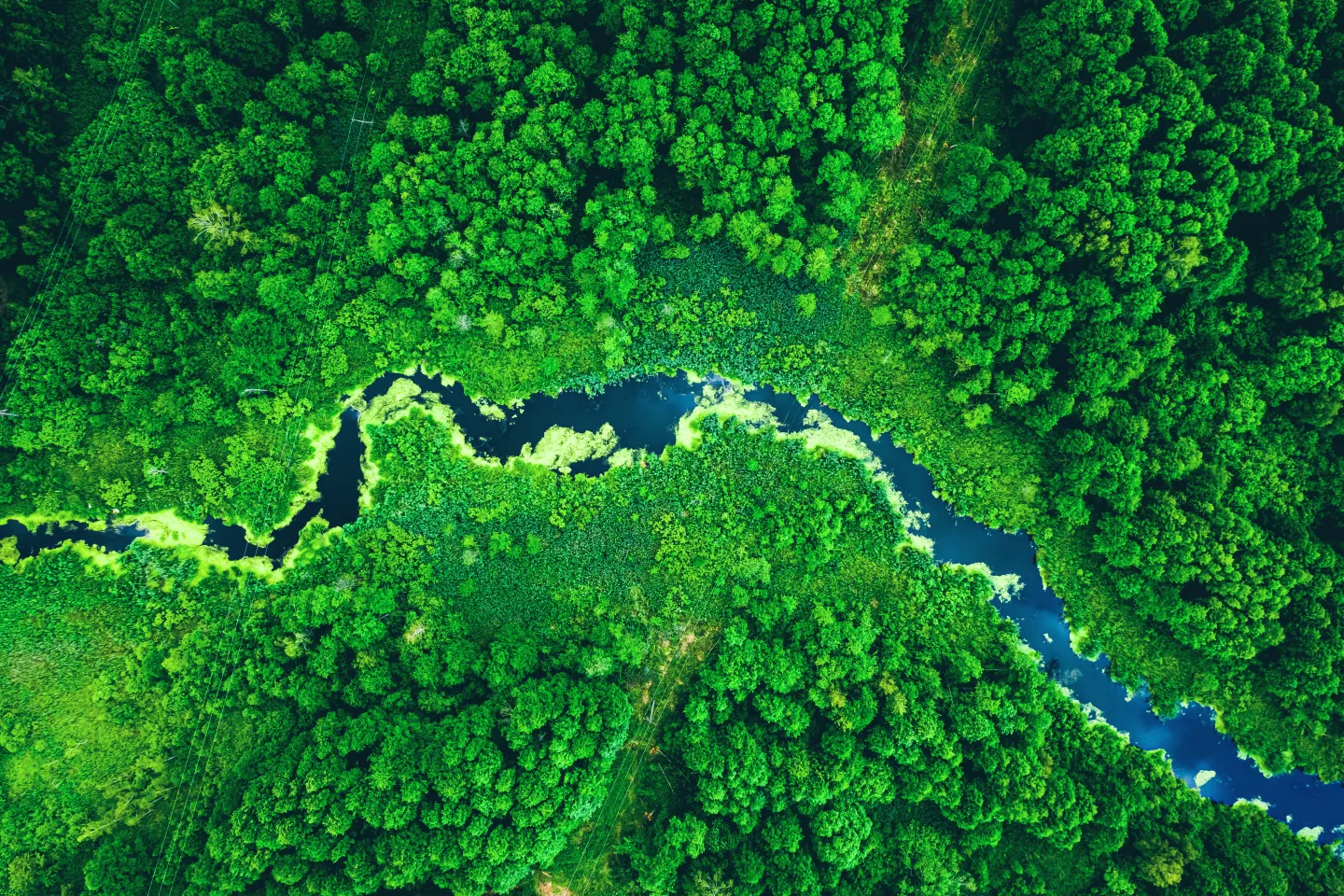

ESG | Empowering Sustainable Growth

Euronext connects local economies to global markets, accelerating innovation and growth, for the transition to a more sustainable economy.

FAQ

No. The Euronext Debt Listing team will verify the ESG documentation on the issuer’s website and display the ESG bonds on the platform automatically.

The categories of potential eligible green projects include, but are not limited to, renewable energy, energy efficiency, sustainable waste management, sustainable land use, biodiversity conservation, clean transportation, climate change and climate adaptation. The categories of potential eligible social projects include, but are not limited to, accessible basic infrastructure, access to essential services, affordable housing, employment generation, food security and socioeconomic advancement.

All issuers should have obtained an independent third-party external review to join Euronext ESG Bonds. Euronext expects this document to be available on the issuer’s website. Shall this external review be missing, Euronext will liaise with the issuer to obtain it.

ESG bond issuers are expected to comply with the recommendations set by the standard that their framework is referring to. Euronext advises issuers to annually publish an allocation report until the full allocation of proceeds, as well as an impact report at least once before the full allocation of proceeds.

Need more information?

Contact one of our experts to get answers to your specific questions.