In recent years, the focus on Environmental, Social, and Governance (ESG) criteria has intensified, pushing companies to reassess their impact on the world. Among these criteria, the social component, which includes diversity and inclusion practices, particularly the position of women in companies, has received significant attention.

Euronext has been at the forefront of promoting ESG transparency and performance among the companies listed on its markets. This includes making company ESG profiles easily available to all; these profiles can be pivotal in understanding the progress and challenges in enhancing gender diversity within corporate leadership roles.

ESG Profiles of listed companies

Euronext’s initiative to highlight ESG profiles empowers investors to make more informed decisions by considering the sustainability and ethical impact of their investments. These profiles showcase various metrics, including carbon footprint, social responsibility, and, critically, gender diversity within each company’s leadership and workforce. The position of women at listed companies, especially in leadership roles, has become a critical metric for evaluating a company's social performance and its commitment to diversity and inclusion.

Diverse research papers, stemming from academic studies, reports from consulting firms and organizations, or even based on financial news and analyses, consistently demonstrate that companies with higher levels of gender diversity, particularly in board positions and senior management, tend to perform better financially and exhibit greater resilience. This is attributed to the greater variety of perspectives brought to the table, which can enhance creativity, innovation, and decision-making processes. Recognising this, investors are increasingly prioritising companies with strong gender diversity metrics, making the ESG profiles provided by Euronext an essential tool in their investment strategies.

Example of ESG Profile tab on Live.euronext.com

Listed companies and gender balance: slow progress, positive direction

Recent data indicates a gradual increase in the number of women in board positions and executive roles within Euronext-listed companies. However, progress is not as fast as could be hoped.

From an analysis of the data[1] available on Euronext’s ESG Profiles, we conclude that since 2020, the average percentage of issuers disclosing gender diversity has significantly improved. In 2022, among the nearly 1,900 companies listed on Euronext, 94% disclose indicators of board gender diversity, while 57% provide information on the number of women in the total workforce. Almost all industries have increased the gender diversity of their boards over the last three years, with large caps advancing faster in this direction, reporting an average 41% of women on their boards, compared to 38% on mid caps’ boards and 27% on small caps’ boards. There is still progress to be made, but all categories have shown positive growth to reach the current status. This positive (although slow) trend is also evident in the average share of women in management bodies[2], which stands at 26% according to the last available registration documents.

In terms of the average share of women in the total workforce, if we split it by industry, it is interesting to note that all sectors have shown improvements over the last three years, surpassing 50% in Health Care and Real Estate, and reaching almost 50% in Financials and Consumer Discretionary. Areas such as Technology have also seen positive development, currently standing at 32%, up from 30% a year ago.

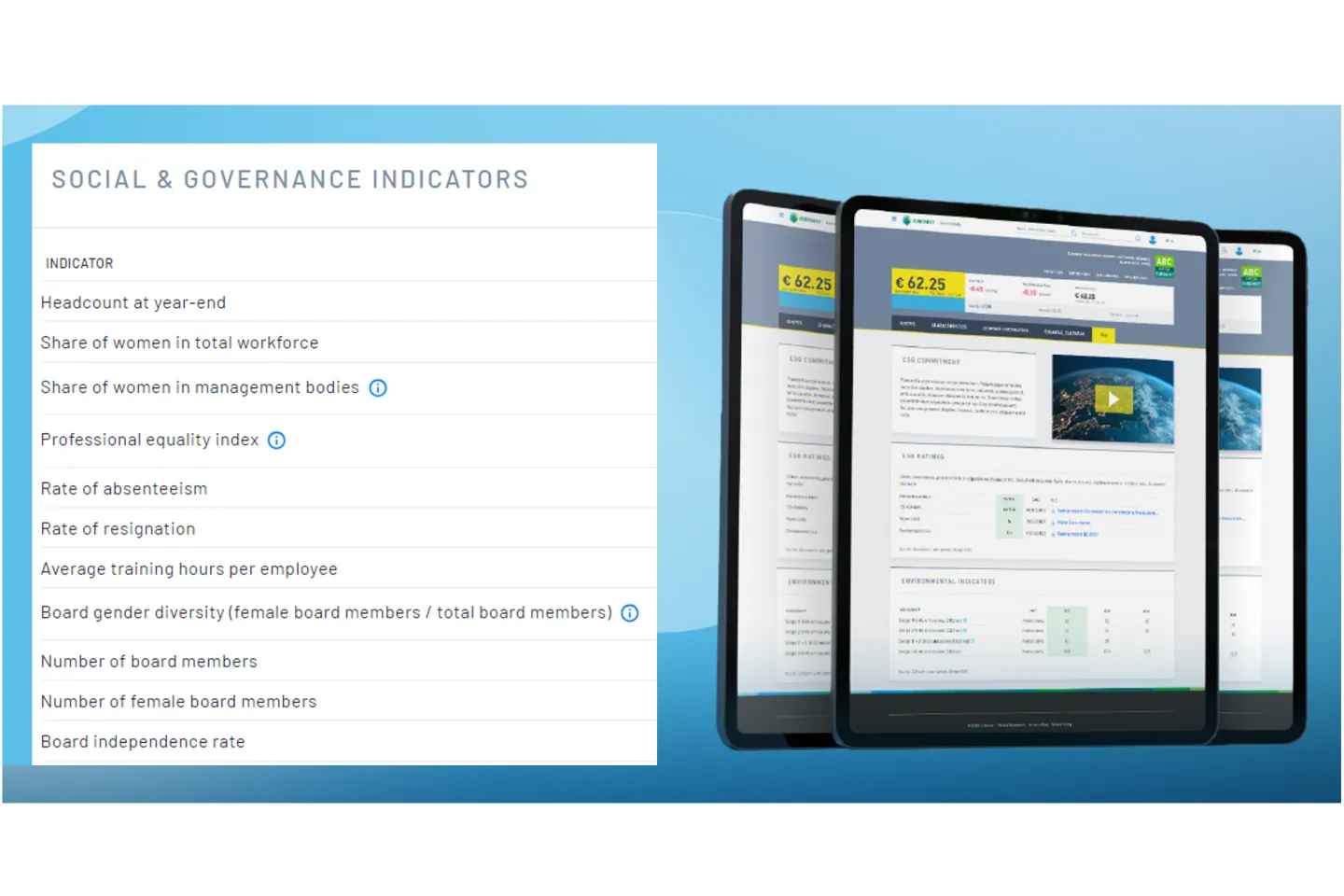

Example - Social & Governance Indicators

Invest in Women: Accelerate Progress

Despite the progress, the journey towards gender parity in the corporate world is far from over. According to recent data, although there has been a gradual increase in the number of women in board positions and executive roles within Euronext-listed companies, the pace of change remains slow, and the glass ceiling is yet to be shattered in many sectors. Challenges such as unequal pay, underrepresentation in leadership roles, and the persistent gender bias in recruitment and promotion practices continue to hinder the progress towards gender equality in the workplace.

Commitment to transparency

Euronext manages various ESG products, such as bonds, derivatives, and ETFs, along with offerings in our corporate services section to support companies on their ESG journey. As a market infrastructure, it plays a pivotal role in directing investments toward ESG projects, underscoring our commitment to promoting sustainable investment practices.

Euronext's commitment to enhancing transparency around ESG practices, including gender diversity, plays a crucial role in addressing these challenges. By offering comprehensive ESG profiles that are easily available to all, Euronext not only assists investors in aligning their portfolios with ethical standards but also encourages companies to embrace more sustainable and inclusive approaches. This, in turn, motivates companies to enhance their gender diversity metrics, as failing to do so could lead to less favourable evaluations by investors who prioritise ESG criteria.

1] Source: Cofisem, Euronext

[2] Executive and Management Committees

Note:

Data refers to end 2022. 2023 reports are not yet available.